Commentary No. 5

August 2011

Chapin White, Paul B. Ginsburg

For local communities, particularly those hit hardest by the great recession, expanding the health care sector may look like an attractive avenue to creating good jobs that can jumpstart a return to prosperity. From the perspective of local leaders, health care expansions are a potential economic boon, while from the perspective of federal policy makers, growth in health care spending is the nation’s greatest long-term fiscal challenge. Understanding the difference between those perspectives, and how it is that they can both be true, is critical to identifying alternative health-financing arrangements that better align local interests with those of the nation.

![]() n the wake of the great recession and a rearranged economic landscape, many communities are struggling to adapt. Michigan and other states in the Midwest are coming to grips with the permanent downsizing of the U.S. auto industry and the manufacturing sector as a whole. Meanwhile, states in the Sun Belt face challenges from the prolonged contraction in the housing and construction sectors.

n the wake of the great recession and a rearranged economic landscape, many communities are struggling to adapt. Michigan and other states in the Midwest are coming to grips with the permanent downsizing of the U.S. auto industry and the manufacturing sector as a whole. Meanwhile, states in the Sun Belt face challenges from the prolonged contraction in the housing and construction sectors.

For an economically distressed community, expanding the health care sector can be appealing on several levels:

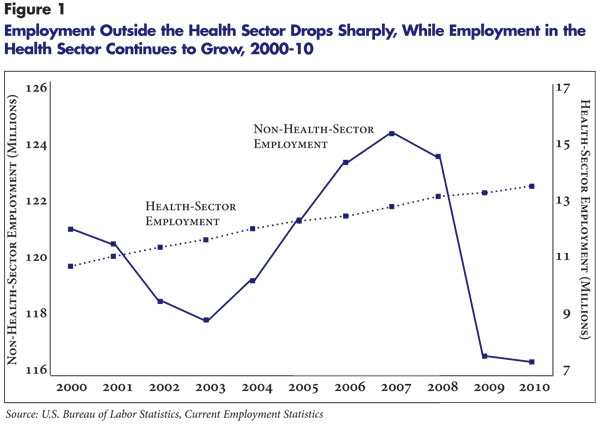

In sharp contrast to the rest of the economy, employment in health care grew steadily throughout the downturn (see Figure 1). Some cite Pittsburgh as a successful model of a city that transformed its economic base from heavy industry to medical care.1 And, there are signs other local officials see health care investments as a way to resuscitate depressed communities.2

Local governments can and do encourage expansion of the health care sector in a variety of ways, including zoning exceptions, tax abatements, and even direct funding of capital improvements and day-to-day operations. In debates within local governments over whether or not to support growth in the health sector, the presumed economic benefits to the local economy often play a role. But while some local governments see a potential boon to their economies from health care expansion, many federal policy makers see growth in health care spending as the “biggest threat to our long-term fiscal future.”3

Understanding why health care spending growth is a problem from a national perspective, while simultaneously an attractive way to promote economic growth from a local perspective, is key to identifying alternative health-financing arrangements that better align local interests with those of the nation.

![]() rom a long-term federal perspective, health care spending growth adds significant strain to a fiscal situation that is already bleak. Federal spending on health care—mainly Medicare and Medicaid—currently equals 5.5 percent of gross domestic product (GDP), and that share is projected roughly to double over the next 25 years.4 To be clear, that projected increase results entirely from growth in health care costs, not the 2010 health reform law. To give some perspective, the projected 25-year growth in federal health spending—roughly 5 percent of GDP—is equal to the current size of the entire Social Security program.

rom a long-term federal perspective, health care spending growth adds significant strain to a fiscal situation that is already bleak. Federal spending on health care—mainly Medicare and Medicaid—currently equals 5.5 percent of gross domestic product (GDP), and that share is projected roughly to double over the next 25 years.4 To be clear, that projected increase results entirely from growth in health care costs, not the 2010 health reform law. To give some perspective, the projected 25-year growth in federal health spending—roughly 5 percent of GDP—is equal to the current size of the entire Social Security program.

The federal government is by no means alone in facing daunting financial pressures from growth in health spending. State governments, which fund a share of Medicaid, employers that provide health benefits and households that purchase insurance are all feeling the strain of health spending trends exceeding the growth in incomes.

Of course, increasing spending on health care is not in and of itself a problem. If the additional spending significantly improves health, then it could be considered a worthwhile investment. And, clearly, advances in medical capabilities have produced tremendous benefits. However, the predominance of third-party payment in the health sector, which means that patients pay much less out of pocket than the cost of the services they use, raises the possibility that additional spending could have less value than the resources sacrificed to pay for it.

Additional factors lead many to believe that rapidly rising health care spending is not necessarily a good investment. First, the uncapped tax exclusion for employer-sponsored health coverage distorts decision making and leads to excessively comprehensive health benefits for many Americans. Second, raising tax rates to pay for rising spending in Medicare and Medicaid reduces overall economic output and increases what economists refer to as “deadweight loss,” or economically worthwhile activities or transactions that fail to take place because of taxation or other price distortions. Third, the U.S. health system is clearly not at the frontier of efficiency—there are other developed countries that spend much less on health care and that have similar levels of quality of care and outcomes. For the purposes of this Commentary, the goal is not to assess the value of increased spending but merely to highlight that local policy makers seeking to create jobs may be working at cross purposes with federal policy makers seeking to rein in the deficit.

![]() or city and county governments, the traditional approach to economic development is to create conditions favorable to manufacturers that encourage them to locate or expand production in the local community. Manufacturing makes sense as a target for economic development because the manufactured goods produced locally generally will be shipped to other parts of the country and, possibly, overseas—the same applies to services that are provided to faraway customers. The revenues generated from sales outside the local community are then returned to local workers and owners and spent on other locally produced goods and services. This creates the so-called multiplier effect, in which production for export spurs employment both inside and outside of the export industry. Locally manufactured goods and locally produced services also can replace goods that would otherwise have to be imported—so-called import substitution—with similar economic effects.

or city and county governments, the traditional approach to economic development is to create conditions favorable to manufacturers that encourage them to locate or expand production in the local community. Manufacturing makes sense as a target for economic development because the manufactured goods produced locally generally will be shipped to other parts of the country and, possibly, overseas—the same applies to services that are provided to faraway customers. The revenues generated from sales outside the local community are then returned to local workers and owners and spent on other locally produced goods and services. This creates the so-called multiplier effect, in which production for export spurs employment both inside and outside of the export industry. Locally manufactured goods and locally produced services also can replace goods that would otherwise have to be imported—so-called import substitution—with similar economic effects.

On the surface, at least, the health sector is not a natural target for economic development because health services cannot in general be sold and shipped outside the local community. It is possible, in a sense, to export health care services by enticing patients living in other areas to travel to a community to receive care—known as medical tourists. But, generally health care economies are exceedingly local. The limits on the exportability of health care are illustrated by the Mayo Clinic in Rochester, Minn. Despite having an exceptional international reputation, only 20 percent of Medicare patients at Mayo hospitals come from outside the tri-state area—Minnesota, Iowa and Wisconsin—and among Mayo surgical patients roughly 2 percent travel from overseas to receive care.5

Many communities have excellent provider systems, but they do not clearly stand out from those in other communities in the same region. For example, a number of Detroit’s hospital systems have reputations for providing high-quality care, but they face tough competition from the University of Michigan system in Ann Arbor and from the Cleveland Clinic. Large employers’ centers of excellence programs, which pay for employees and dependents who need highly specialized services to travel to top U.S. providers, have had limited take up. For the U.S. health care system as a whole, one estimate indicates foreign patients accounted for only $5 billion in revenues in 2008—or two-tenths of a percent of total U.S. health spending.6

In most cases, local capacity expansions will be used by local residents. Some of these residents would have been treated at existing facilities. Without a net gain in the amount of care delivered, the size of the delivery system will not increase, and there will be minimal economic impact. But it is also possible that expanded facilities will lead to increased use of health care services by local residents. This can happen, for example, if services previously unavailable in the community are now offered, or if services are made more convenient or amenities are improved.

Although by no means a consensus, much health policy research over many decades has concluded that expansion of the supply of health services leads to greater use of services. Presumably, those who see expanding the health sector as a spur to economic development—and are aware of the limited opportunities to bring in additional patients from outside the area—believe that the facilities will spur additional health service use. Expansion of the health sector will, over the short run, lead to more construction spending to build the new facilities, and, over the long run, lead to increased employment to staff them. This is seen as spurring activities such as residential construction, retail sales and services.

The increase in local health care employment is not likely to translate one-for-one into reduced unemployment, however, because many new health care jobs will have to be filled by workers who move to the area. After all, the skills required for many health care jobs are specialized, and with the health care industry growing, it means that few of the unemployed worked in that industry. But even if new health care jobs are filled by workers moving in, the associated population growth will boost the local economy through increased housing and retail purchases. While this may diminish the reduction in unemployment, the economic benefits of increased employment will for the most part be achieved.

But this expansion will not come without resulting burdens to portions of the local economy. Greater use of health services will lead to higher private-sector health insurance premiums paid by employers, employees and policyholders in the individual market. Economists believe that over long periods of time, increases in health insurance premiums are borne fully by workers in the form of smaller wage increases. Lower wages paid to local workers will be an important offset to the economic impact of expansions of health services. But, over shorter periods of time, employers will not be able to shift these costs fully and will need to absorb them through a combination of higher product prices and lower profits. This also could have negative impacts on the local economy, particularly on employers competing with firms in other communities or other countries.

![]() f all of the costs of increased health spending were financed by local residents, the attractiveness of strategies to expand the health care sector would be diminished. But given the way health spending is financed in the United States, much of the burden of increased spending on health care will, in fact, be borne outside of the community.

f all of the costs of increased health spending were financed by local residents, the attractiveness of strategies to expand the health care sector would be diminished. But given the way health spending is financed in the United States, much of the burden of increased spending on health care will, in fact, be borne outside of the community.

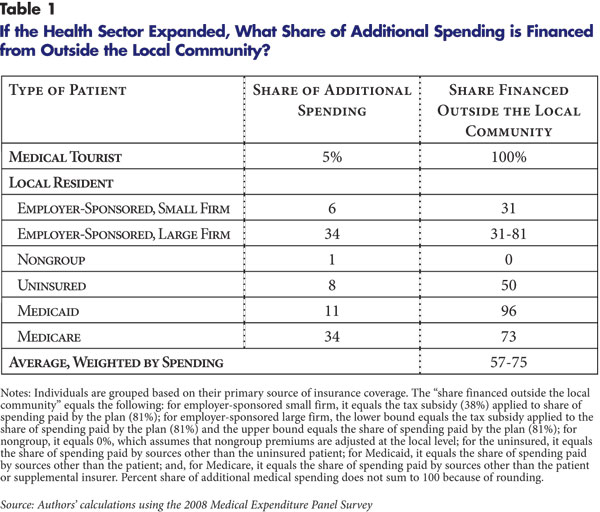

Consider, for example, the Medicare program, which finances roughly 40 percent of all hospital care and physician services. Most of the costs of services provided by Medicare are borne at the national level through federal spending and through beneficiary premiums that are set based on national experience. The only costs for Medicare-covered services borne at the local level are patient cost sharing and premiums for supplemental coverage paid by local employers or individuals. About 73 percent of additional spending by Medicare beneficiaries from an expansion of the local health system would be borne outside the community (see Table 1). The Medicaid program is a more extreme example—it has minimal patient cost sharing and does not charge premiums and, except in a few states that require counties to contribute a share of Medicaid funding, is financed entirely by the federal and state governments. Therefore, close to 100 percent of additional Medicaid spending is borne outside of the community. Even if increased Medicaid spending in a community leads to increased state tax rates, the increase in state taxes will be spread broadly across all taxpayers in the state.

Large portions of the premiums of employment-based coverage are borne outside of the community. Employers that operate in many locations will often have uniform employer and employee contributions for coverage, which means that the effects of increases in health spending in one community will be spread across workers in other communities as well.

Federal and state tax policy also plays a role. The crucial feature of the tax system is the employer tax exclusion, which means that employer contributions to employment-based health coverage, and nearly all employee contributions, are not treated as taxable income. Suppose a local community increases spending on employer-sponsored health benefits by $100, and that, as a result, local workers’ pre-tax wages are reduced by $100 (this so-called full wage offset is a standard assumption used by health economists). As a result, local medical providers’ revenue will increase by roughly $100, but local workers’ take-home pay will only fall by roughly $62 because of the tax advantage of receiving benefits in lieu of wages. The $38 tax wedge provides a boost to the local economy, but it comes from a reduction in tax revenue that will have to be absorbed either through higher federal tax rates on all workers, reduced federal spending or larger federal deficits.

![]() f all of the costs of expanding the local health sector were borne locally, the economic argument for doing so would not stand up. If the full costs of additional health spending were borne by local employers and consumers who pay health insurance premiums and patient cost sharing, it would be clear that initiatives to expand the health system, whatever their merits concerning access to health care, are unlikely to be an economic stimulus.

f all of the costs of expanding the local health sector were borne locally, the economic argument for doing so would not stand up. If the full costs of additional health spending were borne by local employers and consumers who pay health insurance premiums and patient cost sharing, it would be clear that initiatives to expand the health system, whatever their merits concerning access to health care, are unlikely to be an economic stimulus.

But the costs of increased health service use are, in fact, spread widely, with roughly 60 percent to 70 percent of additional spending borne by entities outside of the community. This creates a situation in which it may, in fact, be beneficial to a local economy to support an expansion in health care facilities and services. But as described previously, increased overall health spending could well be a negative for the nation’s economy. So communities have incentives to expand health care capacity to generate local economic benefit, but when many do this, the nation as a whole falls behind as health care spending continues to grow at a much faster pace than the economy.

What can be done do bring national and local considerations into closer alignment? The Patient Protection and Affordable Care Act (PPACA) changes local communities’ incentives to expand health care capacity but in offsetting ways. Medicaid eligibility expansions under health reform, combined with a very high federal Medicaid matching rate, will increase the local benefits from providing services to newly eligible Medicaid patients. Similarly, a significant portion of the premiums of those obtaining private insurance through the new state insurance exchanges will come from federal subsidies. But, the high-premium “Cadillac” excise tax, which will take effect in 2018, will counteract the inflationary effects of the tax exclusion, at least at the high end of the premium distribution.

Probably the most effective strategy for the nation would be to address the open-ended nature of health care financing. The unlimited nature of the tax exclusion for employment-based coverage means that the federal and state governments are silent partners to various aspects of health care that increase costs. The tax exclusion for employer-sponsored insurance could be limited sooner—before 2018—and on a much broader scale than was done in PPACA. The joint federal-state financing for Medicaid diffuses incentives for localities to limit the costs of the program. Structural changes to Medicare benefits and beneficiary premiums have the potential to engage beneficiaries in the cost of their care. And, provider payment reforms that reduce the role of fee for service and put providers at financial risk for more of the costs of patient care would limit the local financial gains from boosting the volume of care through local capacity expansions. These changes could help align local and national leaders’ attitudes toward expansions of the health sector.

| 1. | Vladeck, Bruce C., “The Political Economy of Medicare,” Health Affairs, Vol. 18, No. 1 (January/February 1999). |

| 2. | Christianson, Jon, et al., Detroit: Motor City to Medical Mecca? Community Report, National Institute for Health Care Reform, Washington, D.C. (August 2010). |

| 3. | Office of Management and Budget, “OMB Director Focuses on ‘Rescue, Recovery, and Reining in the Deficit’ at NYU,” News Release (Nov. 3, 2009). Although the nation’s fiscal future is most directly affected by government health spending, the fact that public and private spending draws on a common delivery system is the source of this broader concern. Available at http://www.whitehouse.gov/omb/news_110309_nyu/. |

| 4. | Congressional Budget Office, The Long-Term Budget Outlook, Washington, D.C. (June 2010). Available at http://cbo.gov/ftpdocs/115xx/doc11579/06-30-LTBO.pdf. |

| 5. | Gajic, Ognjen, et al., “Long-Haul Air Travel Before Major Surgery: A Prescription for Thromboembolism?” Mayo Clinic Proceedings, Vol. 80, No. 6 (June 2005). |

| 6. | Deloitte Center for Health Solutions, Medical Tourism: Consumers in Search of Value, Washington, D.C. (2008). Available at http://www.deloitte.com/assets/Dcom-unitedStates/Local%20Assets/Documents/us_chs_MedicalTourismStudy(3).pdf. |

This Commentary was funded by the Robert Wood Johnson Foundation.

COMMENTARIES are published by the Center for Studying Health System

Change.

600 Maryland Avenue, SW, Suite 550

Washington, DC 20024-2512

Tel: (202) 484-5261

Fax: (202) 484-9258

www.hschange.org