Tracking Health Care Costs:

Hospital Care Key Cost Driver in 2000

Data Bulletin No. 21 - Revised

September 2001

Bradley C. Strunk, Paul B. Ginsburg, Jon R. Gabel

ospital spending accounted for the largest portion—43 percent—of

medical cost increases in 2000 (see Figure 1). Overall,

health care spending growth per privately insured person increased 7.2 percent

in 2000—the largest year-to-year increase since 1990

(see Table

1).

Rapid rises in underlying medical costs, double-digit premium increases and the

slowing economy could create a volatile combination that may increase consumers’

out-of-pocket costs and the ranks of the uninsured.

ospital spending accounted for the largest portion—43 percent—of

medical cost increases in 2000 (see Figure 1). Overall,

health care spending growth per privately insured person increased 7.2 percent

in 2000—the largest year-to-year increase since 1990

(see Table

1).

Rapid rises in underlying medical costs, double-digit premium increases and the

slowing economy could create a volatile combination that may increase consumers’

out-of-pocket costs and the ranks of the uninsured.

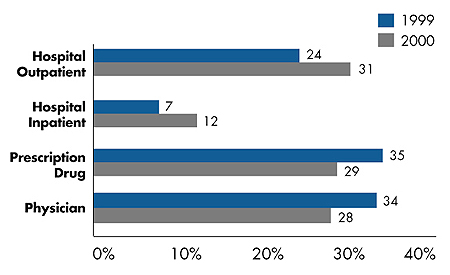

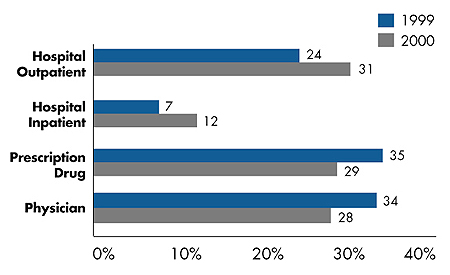

FIGURE 1

SOURCES OF COST INCREASE, 1999 AND 2000 |

|

Note: 1999 sources of cost increase reflect August 2001

revision in spending data by Milliman USA.

Source: Milliman USA Health Cost Index ($0 deductible) |

Back to Top

Underlying Cost Trends

n 2000, health care spending reflected significant shifts in growth of

underlying cost components, particularly for hospital services (see Figure 1).

n 2000, health care spending reflected significant shifts in growth of

underlying cost components, particularly for hospital services (see Figure 1).

- Spending for outpatient care increased 11.2 percent in 2000,

accounting for 31 percent of the overall increase. The 2000

outpatient spending increase was the largest since 1992.

- Spending for inpatient care increased 2.8 percent in 2000,

accounting for 12 percent of the overall increase. The inpatient

increase signals a dramatic departure from the 1994-98 trend,

when inpatient spending actually declined year-to-year by as

much as 5.3 percent.

Consumer demand for broad networks of hospitals and physicians and the retreat

from tightly managed care—coupled with hospital consolidation and reduction in

excess capacity—have increased some hospitals’ bargaining leverage with health

plans. Growing numbers of contract showdowns between providers and health plans

are occurring as providers use their clout to gain higher payments.

Health care payroll growth also is a key driver of overall costs. Payroll costs

for all health services increased 4.7 percent in 2000, compared to 3.1 percent

in 1999, while hospital payroll costs increased 3.7 percent in 2000, compared

to 2.6 percent in 1999. The higher payroll growth in 2000 is largely accounted

for by increased growth in hours worked rather than faster-growing average hourly

wages. But during the first five months of 2001, average hourly wage growth increased

sharply, particularly for hospitals, perhaps because of nursing and other staff

shortages.

Other underlying cost trends include:

- Spending growth for prescription drugs—while still very high—slowed, dropping

to 14.5 percent and accounting for 29 percent of the overall increase in 2000.

Two factors likely caused the reduction: a lack of new "blockbuster" drugs

and the shift to three-tier pharmacy benefits.

- Spending growth for physician services slowed in 2000 to 4.8 percent, accounting

for 28 percent of the overall increase.

Back to Top

Implications for Consumers

n 2001, employer-based insurance

premiums increased 11 percent-the

fifth straight year of rising premiums

and the highest increase since 1993.

The large difference between the 2001 premium increase and the underlying cost

increase in 2000-11 percent vs. 7.2 percent-reflects both expectations of higher

costs and the health insurance underwriting cycle, or the pattern of premium trends

diverging from expected costs. The expectation of higher costs is reflected in

the 9.5 percent premium increase for self-insured plans in 2001. The underwriting

cycle is reflected by the much higher premium increase of 12.3 percent for fully

insured plans in 2001, signaling insurers’ willingness to sacrifice market share

to restore profit margins.

Insured consumers generally have been sheltered from cost increases in recent

years because employers have paid a disproportionate share of higher premiums

in past years. In 2001, the employee share of premiums remained stable at 15 percent

for single coverage and 27 percent for family coverage. But, with a slowing economy,

this could change. Indeed, employers have increased patient cost sharing already

for pharmaceuticals and are expected to do the same for hospital and physician

services. In contrast to the last time cost trends were this high-in the early

1990s-the cost-containment strategies of managed care are now in retreat, leaving

few ways to stem the rising cost tide.

n 2001, employer-based insurance

premiums increased 11 percent-the

fifth straight year of rising premiums

and the highest increase since 1993.

The large difference between the 2001 premium increase and the underlying cost

increase in 2000-11 percent vs. 7.2 percent-reflects both expectations of higher

costs and the health insurance underwriting cycle, or the pattern of premium trends

diverging from expected costs. The expectation of higher costs is reflected in

the 9.5 percent premium increase for self-insured plans in 2001. The underwriting

cycle is reflected by the much higher premium increase of 12.3 percent for fully

insured plans in 2001, signaling insurers’ willingness to sacrifice market share

to restore profit margins.

Insured consumers generally have been sheltered from cost increases in recent

years because employers have paid a disproportionate share of higher premiums

in past years. In 2001, the employee share of premiums remained stable at 15 percent

for single coverage and 27 percent for family coverage. But, with a slowing economy,

this could change. Indeed, employers have increased patient cost sharing already

for pharmaceuticals and are expected to do the same for hospital and physician

services. In contrast to the last time cost trends were this high-in the early

1990s-the cost-containment strategies of managed care are now in retreat, leaving

few ways to stem the rising cost tide.

Back to Top

This Data Bulletin is based on data from the Milliman USA Health Cost Index

($0 deductible), which is designed to reflect claims increases faced by private

insurers; the Kaiser Family Foundation/Health Research and Educational Trust

survey of employer-based health plans for 1999-2001; the KPMG survey of employer-based

plans for 1991-98; the U.S. Bureau of Labor Statistics Employment, Hours and

Earnings series to track payroll costs; and Center for Studying Health System

Change 2000-01 site visits (see www.hschange.org). The bulletin is adapted from

“Tracking Health Care Costs,” by Bradley C. Strunk, Paul B. Ginsburg and Jon

R. Gabel, Health Affairs, Web-exclusive publication, Sept. 26, 2001,

www.healthaffairs.org.

Data Bulletins are published by the Center for Studying Health System Change

(HSC)

President: Paul B. Ginsburg

Director of Public Affairs: Ann C. Greiner

Editor: The Stein Group