Community Report No. 2

Winter 2003

Suzanne Felt-Lisk, Jon B. Christianson, Linda R. Brewster, Ashley C. Short, Richard Sorian, Robert E. Hurley, Lawrence D. Brown, Gigi Y. Liu

- Provider Systems Seek Higher Payment, Consumer Loyalty

- Physicians Pressured to Align with Only One System

- Malpractice Insurance Spike Concerns Many Physicians

- Employers Begin to Shift Costs to Consumers

- Health Plan Response to Rising Costs Is Muted

- ER Crowding Continues

- A Stronger Safety Net: Can It Be Sustained in Bad Times?

- Issues to Track

- Cleveland Consumers’ Access to Care, 2000

- Background and Observations

Provider Systems Seek Higher Payment, Consumer Loyalty

Over the past two years, the systems increasingly have used their leverage to win higher payment rates and more favorable contract terms from health plans. Under pressure from providers, risk-based contracts with managed care plans—once viewed as likely to become standard—have nearly disappeared. The systems also exerted leverage by negotiating master contracts covering all hospital and physician components, putting pressure on plans by presenting a united front. Multiple health plan respondents reported substantial provider rate increases over the past two years, contributing to a double-digit annual growth rate in local medical cost trends.

Improved reimbursement has helped to offset financial pressures from rising wages needed to attract nurses and other skilled hospital workers, Medicare payment changes that have resulted in declining revenue and higher malpractice insurance premiums. Despite growth of the two systems’ operating margins, both were forced to reduce capital spending because of stock market losses. The Cleveland Clinic, in particular, sustained heavy losses due to an unusually aggressive investment strategy.

Nonetheless, vigorous competition between the two systems continued as the bricks-and-mortar war of 2000 shifted to a battle of billboard, TV and radio ads touting the systems’ commitment to quality and service. Two years ago, the systems were engaged in expensive building campaigns—now almost complete—designed to expand their reach in the Cleveland suburbs through new family health centers and ambulatory surgery centers. With the new centers open, the systems have turned their attention to attracting patients. In addition, there are signs the systems may have expanded their suburban outposts too much, with reports that some family health centers are underused. The possibility of excess capacity and duplication of services raises serious questions about the systems’ competition contributing to rising health care costs.

The systems also have been vying for the upper hand in medical research. Historically, University Hospitals enjoyed the distinction of an exclusive academic medical affiliation with Case Western Reserve University. This long-standing relationship helped the hospital system to attract prominent physicians and secure medical research funding. In recent years, however, the alliance was jeopardized by disputes about research funding allocations. After several years of contentious negotiations, the two recently agreed to a 50-year commitment to combine research efforts under the leadership of a new medical school dean.

In the interim, Case Western also affiliated with the Cleveland Clinic to establish a new medical school focused on training physician researchers. As a result, students will take a common first year, then split into two branches, each with an affiliation with one of the two provider systems. This change may diminish University Hospitals’ competitive advantage by virtue of its formerly exclusive relationship with Case Western, but it also presents opportunities for greater cooperation between the two systems in medical research.

In addition to the Case Western difficulties, UHHS has suffered other setbacks, including the departure of a high-profile CEO, the loss of thoracic surgery training accreditation, temporary shutdowns of heart and lung transplant programs and the loss of the prominent leader of the system’s research institute. Market watchers are keeping a close eye on developments to see if University Hospitals will rebound or weaken. If it weakens, the current costs of so-called one-upmanship between the two systems would likely diminish. However, the Cleveland Clinic might then dominate certain high-end specialty services, leading to additional market power that could translate into higher costs for consumers.

Physicians Pressured to Align with Only One System

![]() any physicians who traditionally have admitted patients to both systems’ hospitals are under pressure to choose one system. While both systems have pressured physicians, University Hospitals has taken a more aggressive stance by using economic credentialing when granting physicians admitting privileges at its hospitals. This means that physicians with privileges at any fully or partially owned University Hospitals facility must notify the system if they have privileges at any Cleveland Clinic facility or any financial interest in a CCHS-sponsored activity. UHHS has been particularly aggressive with physicians employed by CCHS, rescinding some of these physicians’ admitting privileges, which has prompted 10 of them to sue UHHS. The outcome of the pending lawsuit could affect the competitive dynamic between the battling

systems. Moreover, UHHS’s health plan, QualChoice, has dropped contracts with three CCHS-owned hospitals and about 140 physicians affiliated with the hospitals.

any physicians who traditionally have admitted patients to both systems’ hospitals are under pressure to choose one system. While both systems have pressured physicians, University Hospitals has taken a more aggressive stance by using economic credentialing when granting physicians admitting privileges at its hospitals. This means that physicians with privileges at any fully or partially owned University Hospitals facility must notify the system if they have privileges at any Cleveland Clinic facility or any financial interest in a CCHS-sponsored activity. UHHS has been particularly aggressive with physicians employed by CCHS, rescinding some of these physicians’ admitting privileges, which has prompted 10 of them to sue UHHS. The outcome of the pending lawsuit could affect the competitive dynamic between the battling

systems. Moreover, UHHS’s health plan, QualChoice, has dropped contracts with three CCHS-owned hospitals and about 140 physicians affiliated with the hospitals.

A high percentage of Cleveland physicians are employed by hospitals, and many other physicians are aligned with one of the systems through hospital-based contracting organizations. The extent to which employed and aligned physicians have benefited from the systems’ increased payments from health plans is unclear. Some observers believed the hospital systems used their leverage with plans for higher hospital payment rates more than for physician rates.

Malpractice Insurance Spike Concerns Many Physicians

![]() ising malpractice premiums are a big problem for Ohio physicians, and the malpractice climate in Cuyahoga County reportedly is the worst in the state. The greatest impact has been on obstetrician/

gynecologists and neurologists. One respondent reported that malpractice insurance premiums for obstetrician/ gynecologists in Cuyahoga County had risen to $60,000 by June 2002 and then to

about $100,000 based on early reports for the November renewal cycle. The increases were so rapid that their full impact was not yet clear. Although no overall physician shortages were noted, they could develop if premiums continue to rise.

ising malpractice premiums are a big problem for Ohio physicians, and the malpractice climate in Cuyahoga County reportedly is the worst in the state. The greatest impact has been on obstetrician/

gynecologists and neurologists. One respondent reported that malpractice insurance premiums for obstetrician/ gynecologists in Cuyahoga County had risen to $60,000 by June 2002 and then to

about $100,000 based on early reports for the November renewal cycle. The increases were so rapid that their full impact was not yet clear. Although no overall physician shortages were noted, they could develop if premiums continue to rise.

Physicians have retired, left the state, taken leaves of absence, dropped high-risk procedures and sought salaried employment (so their employer would pay for malpractice insurance). Many physicians have become politically active because they believe the tort system, especially the state’s lack of limits on noneconomic damages, is a major source of the problem. The Ohio Supreme Court has struck down two previous tort reform laws, but the recent addition of two reform-minded judges to the court may signal a change in prospects. Consumer groups and trial lawyers opposing tort reform say that in Ohio, as elsewhere, medical errors and insurance companies raising rates to recoup losses from poor underwriting and investments are responsible for the crisis. Out of all this controversy has emerged a new law restricting the total payment for pain and suffering, which physicians see as a good first step, but which is not expected to affect liability insurance premiums in the short term.

Employers Begin to Shift Costs to Consumers

![]() leveland’s economic downturn appears to be influencing employer and consumer responses to rising health care costs.

leveland’s economic downturn appears to be influencing employer and consumer responses to rising health care costs.

Unemployment rose from 4.9 percent in September 2001 to 6.2 percent in September 2002, mirroring national trends. However, the job losses may be felt more acutely locally because Cleveland lost several high-profile large employers, including LTV Steel, which declared bankruptcy, laid off several thousand workers and reopened on a smaller scale. Because the economic downturn in Cleveland appears to be fueled by an ongoing shift in the economy away from manufacturing, along with the national downturn, it may take longer for the city to rebound.

Combined with big health insurance premium increases, local economic woes have strengthened employers’ inclination to pass on increased costs to consumers through higher deductibles and copayments. Now, many firms are eying hikes to workers’ share of the up-front premium. While most local workers have accepted the increases without notable protest, General Electric workers in Cleveland joined a nationwide two-day walkout to protest planned cost-sharing increases.

In general, labor and management agree that the cost-shifting strategy cannot be sustained for long if cost increases continue unabated. Most employers want to get workers more involved in health care decision making, but they remain leery of consumer-driven health plans, citing administrative or conceptual complexity, lack of large-scale working models to inspire confidence, union and provider opposition and skepticism about cost-containment potential.

Meanwhile, local employers’ focus on rising costs and Clevelanders’ pride in the reputations of the two major hospital systems have left little appetite for quality initiatives. The 1999 collapse of Cleveland Health Quality Choice, a nationally known, decade-long program that provided comparative hospital data to purchasers and consumers, has contributed to local skepticism about the potential of market-led quality efforts.

While the general mood is grim, Cleveland business and civic leaders hope the city can rebound through reinvention as a center of biotechnology research and development, capitalizing on the Cleveland Clinic and University Hospitals’ successes.

Health Plan Response to Rising Costs Is Muted

![]() ealth plans have not tried aggressively to constrain cost growth in the Cleveland market, in part because employers have not urged them to do so, and because of their limited leverage in such a highly consolidated

provider market. As a result, plan cost-control efforts have centered on two strategies: care management programs and new products aimed at making consumers and providers more cost-conscious.

ealth plans have not tried aggressively to constrain cost growth in the Cleveland market, in part because employers have not urged them to do so, and because of their limited leverage in such a highly consolidated

provider market. As a result, plan cost-control efforts have centered on two strategies: care management programs and new products aimed at making consumers and providers more cost-conscious.

Care Management Programs. Most plans in Cleveland continue to offer an array of disease management programs for such conditions as asthma, heart problems and diabetes. Plans and employers believe these programs are improving care and reducing costs, although solid evidence is scarce to date.

New Product Offerings. Consumer-driven health plans and tiered-network structures are generating a lot of talk and some initial activity, but employer reservations and provider opposition may limit the growth of these products in Cleveland. At least one plan, Medical Mutual of Ohio (MMO), the former Blue Cross Blue Shield plan, now offers a consumer-driven option with a spending account to cover care up to certain dollar threshold, coupled with a high-deductible insurance policy. So far, employers have been skeptical of the concept and reluctant to be the first to try such a different type of product. At least two plans—Medical Mutual and Anthem Blue Cross Blue Shield—now offer products that allow employees to choose from several benefit options with different premiums.

Plans also are developing tiered-network products, where consumers typically pay more out of pocket to go to higher-cost hospitals in the plan’s network. Although plans expect employer interest in tiered networks, none of these products was operational yet.

Meanwhile, a potential rift between Medical Mutual and the Cleveland Clinic may lead to further shifts in the balance of power between plans and providers. Medical Mutual has a long-standing exclusive affiliation with CCHS in exchange for discounted payment rates. The arrangement has given MMO a price advantage that is particularly important in a fragmented insurance market, with enrollment spread across multiple players. However, CCHS is concerned that MMO has passed along discounts to third parties without Cleveland Clinic’s permission. If this disagreement were to intensify, it could lead Cleveland Clinic to sever the exclusive relationship with Medical Mutual—a possibility strengthened by the growing local presence of SummaCare, an Akron-based plan with ties to CCHS that offers another contracting vehicle for the system.

Such a change could have significant effects on the health plan market, particularly if it signals a shift away from the exclusive plan-provider contracting arrangements that have been notable features of the market. Unlike in many other communities, Cleveland consumers have accepted restricted provider networks with a single health system, even in an era of consumer backlash against managed care and demand for broad provider choice. These arrangements presumably have helped plans to hold the line on provider payment rates to some degree, which, if unsuccessful, could further weaken plans’ ability to control costs in the market.

ER Crowding Continues

![]() leveland hospital emergency departments continue to struggle with crowding

because of higher demand for services and staff and bed shortages. After two hospitals

closed in 1999, other Cleveland hospitals received an influx of new emergency

room patients that has not abated. For example, Cleveland’s public hospital,

MetroHealth Medical Center, saw annual emergency room visits jump from about

55,000 in 1999 to a current level of 68,000-70,000 visits a year. A shortage of nurses

and beds available in hospital intensive care units (ICUs) is a second major reason for

the crowding. The ICU problems cause some patients who need inpatient care to

have to wait in the emergency room.

leveland hospital emergency departments continue to struggle with crowding

because of higher demand for services and staff and bed shortages. After two hospitals

closed in 1999, other Cleveland hospitals received an influx of new emergency

room patients that has not abated. For example, Cleveland’s public hospital,

MetroHealth Medical Center, saw annual emergency room visits jump from about

55,000 in 1999 to a current level of 68,000-70,000 visits a year. A shortage of nurses

and beds available in hospital intensive care units (ICUs) is a second major reason for

the crowding. The ICU problems cause some patients who need inpatient care to

have to wait in the emergency room.

Because of the crowding, ambulances were diverted more and more frequently. In response, the Cuyahoga County emergency medical services program established a protocol to direct ambulances where to go when hospitals go on diversion and to prevent all hospitals from diverting ambulances at the same time. The protocol has reduced diversions considerably, although waits for emergency room care are still substantially longer than they were in 1998. MetroHealth Medical Center, the city’s only Level I trauma center, is constructing a new emergency room with expanded capacity.

A Stronger Safety Net: Can It Be Sustained in Bad Times?

![]() leveland’s safety net is stronger than it was two years ago.

At that time, some safety net providers had major financial difficulties, and

two hospitals that served many uninsured people had recently closed. In the past

two years, improvements were made on several fronts:

leveland’s safety net is stronger than it was two years ago.

At that time, some safety net providers had major financial difficulties, and

two hospitals that served many uninsured people had recently closed. In the past

two years, improvements were made on several fronts:

State and local policy makers have maintained financial support for safety net programs and providers despite severe budget challenges that forced cuts in other public programs. According to observers, advocates for the poor in Cleveland are both energetic and unusually skilled at influencing the safety net policies of the predominantly conservative Ohio Legislature.

Serious concerns loom, however, as Cleveland’s economic downturn, along with the continuing rise in health insurance premiums, likely has already increased the number of uninsured. The state’s budget crisis, fueled in part by rapid Medicaid spending growth, has made the program a prime target for cuts, including potential rollbacks of the recent Medicaid/SCHIP eligibility expansion.

Another trouble spot is Medicaid managed care, which has continued to be plagued by plan failures and withdrawals. Some safety net providers reported increases in the number of Medicaid patients seeking care in emergency rooms after plans have left the program. However, few beneficiaries have had to change physicians when they changed plans, and the state reported no increase in beneficiary complaints when plans exited the program. Given the troubled history and the fact that only two plans remain, some providers and advocates would like to see the program shift from mandatory to voluntary.

Issues to Track

![]() ver the past two years, the two major

systems used new leverage with health

plans, shifted the ways in which they com-pete

and pressured physicians to admit

patients exclusively to the hospitals of one

system or the other. The pressures building

in the Cleveland market have potentially

serious implications for consumers.

ver the past two years, the two major

systems used new leverage with health

plans, shifted the ways in which they com-pete

and pressured physicians to admit

patients exclusively to the hospitals of one

system or the other. The pressures building

in the Cleveland market have potentially

serious implications for consumers.

Key issues include:

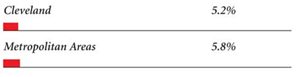

Cleveland Consumers’ Access to Care, 2000

Cleveland compared to metropolitan areas with over 200.000 population

| Unmet Need |

| PERSONS WHO DID NOT GET NEEDED MEDICAL CARE DURING THE LAST 12 MONTHS |

|

| Delayed Care |

| PERSONS WHO DELAYED GETTING NEEDED MEDICAL CARE DURING THE LAST 12 MONTHS |

|

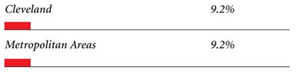

| Out-of-Pocket Costs |

| PRIVATELY INSURED PEOPLE IN FAMILIES WITH ANNUAL OUT-OF-POCKET COSTS OF $500 OR MORE |

|

| Access to Physicians |

| PHYSICIANS WILLING TO ACCEPT ALL NEW PATIENTS WITH PRIVATE INSURANCE |

|

| PHYSICIANS WILLING TO ACCEPT ALL NEW MEDICARE PATIENTS |

|

| PHYSICIANS WILLING TO ACCEPT ALL NEW MEDICAID PATIENTS |

|

| PHYSICIANS PROVIDING CHARITY CARE |

|

| * Site value is significantly different from the mean for large metropolitan

areas over 200,000 population at p<.05. # Indicates a 12-site high. Source: HSC Community Tracking Study Household and Physician Surveys, 2000-01 Note: If a person reported both an unmet need and delayed care, that person is counted as having an unmet need only. Based on follow-up questions asking for reasons for unmet needs or delayed care, data include only responses where at least one of the reasons was related to the health care system. Responses related only to personal reasons were not considered as unmet need or delayed care. |

Background and Observations

| Cleveland Demographics | |

| Cleveland | Metropolitan areas 200,000+ population |

| Population1 2,245,681 |

|

| Persons Age 65 or Older2 | |

| 15% | 11% |

| Median Family Income3 | |

| $29,808 | $31,883 |

| Unemployment Rate3 | |

| 6.3% | 5.8% |

| Persons Living in Poverty2 | |

| 12% | 12% |

| Persons Without Health Insurance2 | |

| 8% | 13% |

| Age-Adjusted Mortality Rate per 1,000 Population4 | |

| 9.2 | 8.8* |

* National average. Sources: |

|

| Health Care Utilization | |

| Cleveland | Metropolitan areas 200,000 population |

| Adjusted Inpatient Admissions per 1,000 Population 1 | |

| 235 | 180 |

| Persons with Any Emergency Room Visit in Past Year 2 | |

| 24% | 19% |

| Persons with Any Doctor Visit in Past Year 2 | |

| 79% | 78% |

| Average Number of Surgeries in Past Year per 100 Persons 2 | |

| 19 | 17 |

| Sources: 1. American Hospital Association, 2000 2. HSC Community Tracking Study Household Survey, 2000-01 |

|

| Health System Characteristics | |

| Cleveland | Metropolitan areas 200,000+ population |

| Staffed Hospital Beds per 1,000 Population1 | |

| 3.4 | 2.5 |

| Physicians per 1,000 Population2 | |

| 2.1 | 1.9 |

| HMO Penetration, 19993 | |

| 29% | 38% |

| HMO Penetration, 20014 | |

| 32% | 37% |

| Medicare-Adjusted Average per Capita Cost (AAPCO) Rate, 20025 | |

| $605 | $575 |

| Sources: 1. American Hospital Association, 2000 2. Area Resource File, 2002 (includes nonfederal, patient care physicians, except radiologists, pathologists and anesthesiologists) 3. InterStudy Competitive Edge, 10.1 4. InterStudy Competitive Edge, 11.2 5. Centers for Medicare and Medicaid Services. Site estimate is payment rate for largest county in site; national estimate is national per capita spending on Medicare enrollees in Coordinated Care Plans in December 2002. |

|