Community Report No. 7

Summer 2003

Glen P. Mays, Sally Trude, Lawrence P. Casalino, Laurie E. Felland, Gary Claxton, Jessica H. May, Megan McHugh, Lydia E. Regopoulos

More health plan consolidation, higher health care costs and persistent hospital difficulties signal increasing concern about the future of the Syracuse health care market. The dominant insurer, Excellus BlueCross BlueShield, has bolstered its market position through a string of recent acquisitions. Meanwhile, after attempted alliances faltered, hospitals are pursuing costly capital improvements to enhance their competitive position. One of these institutions, Crouse Hospital, has remained in bankruptcy since 2001.

Other important developments include:

- Insurance Market Consolidates amid New Competition

- Hospitals Pursue Capital Improvements as Alliances Falter

- Physicians Build New Facilities, Purchase High-Tech Equipment

- Public Insurance Expansions and Safety Net Remain Intact

- Issues to Track

- Syracuse Consumers’ Access to Care, 2001

- Background and Observations

Insurance Market Consolidates amid New Competition

![]() yracuse’s health insurance market has experienced both

continued consolidation and emerging competition, altering the insurance choices

and costs faced by employers and consumers. Excellus, a subsidiary of Lifetime

Healthcare Cos., extended its dominance in the largely indemnity-based health

insurance market through acquisitions and new product development. Its acquisitions

during 2000 and 2001 included Univera—the area’s largest health maintenance

organization—a leading third-party administrator and a small business

association. Excellus also reintroduced a Medicaid managed care product during

2001 after discontinuing a similar offering in 1997. Collectively, these actions

allowed Excellus to control approximately 48 percent of the Syracuse health

insurance market.

yracuse’s health insurance market has experienced both

continued consolidation and emerging competition, altering the insurance choices

and costs faced by employers and consumers. Excellus, a subsidiary of Lifetime

Healthcare Cos., extended its dominance in the largely indemnity-based health

insurance market through acquisitions and new product development. Its acquisitions

during 2000 and 2001 included Univera—the area’s largest health maintenance

organization—a leading third-party administrator and a small business

association. Excellus also reintroduced a Medicaid managed care product during

2001 after discontinuing a similar offering in 1997. Collectively, these actions

allowed Excellus to control approximately 48 percent of the Syracuse health

insurance market.

Excellus has begun to consolidate and standardize its various insurance products in Syracuse, which has helped to reduce administrative costs but also has raised concerns about the company’s growing market dominance. As Excellus consolidated its products, physicians complained these changes required them to serve more patients under Excellus’ fee schedules, which were lower than fee schedules offered by Univera and other insurers. Physicians also objected to preauthorization requirements they attribute to Excellus; however, in many cases these are actually imposed by large, self-insured employers that use Excellus as their third-party administrator.

Despite Excellus’ dominant position, HealthNow, the parent company of BlueCross BlueShield of Western New York, began marketing products without the Blue trademark in Syracuse in 2002, triggering increased price competition. The two BlueCross BlueShield holding companies have long competed for control of upstate New York. HealthNow’s entry has given Syracuse employers and consumers some new insurance choices, helping to compensate for the retreat of national plans CIGNA and United HealthCare from the market in recent years. HealthNow reportedly entered the market with premiums 10 percent to 15 percent lower than those of Excellus and other competitors, providing small and mid-size employers with some relief from annual double-digit premium increases.

The heightened price competition among insurers appears to have helped small businesses avoid the large increases in consumer cost sharing adopted by their counterparts in other markets, at least for the current contract year. However, HealthNow’s entry has had little effect on insurance costs for larger employers, most of which are self-insured and have been sheltered from double-digit cost increases until recently. Some respondents questioned HealthNow’s ability to maintain these lower premiums.

Hospitals Pursue Capital Improvements as Alliances Falter

![]() fter several failed attempts to combine operations, Syracuse hospitals are pursuing

major improvements in facilities and services independently in an effort to compete for

profitable patients and address lingering financial difficulties. The 550-bed Crouse

Hospital, one of the largest of Syracuse’s four hospitals, is planning a $70-million

capital investment over the next five years to upgrade aging infrastructure and

improve service delivery. Although its financial performance has improved

significantly since it entered bankruptcy reorganization in 2001, Crouse views

these investments as essential for achieving long-term financial health.

fter several failed attempts to combine operations, Syracuse hospitals are pursuing

major improvements in facilities and services independently in an effort to compete for

profitable patients and address lingering financial difficulties. The 550-bed Crouse

Hospital, one of the largest of Syracuse’s four hospitals, is planning a $70-million

capital investment over the next five years to upgrade aging infrastructure and

improve service delivery. Although its financial performance has improved

significantly since it entered bankruptcy reorganization in 2001, Crouse views

these investments as essential for achieving long-term financial health.

At the same time, neighboring University Hospital is pursuing $85 million in state funding to upgrade and expand its facilities and offer an array of new specialty services, including a children’s hospital. These improvements are expected to bolster the competitive position of the state-owned academic medical center and generate additional patient volume for its teaching programs. Although observers acknowledged the need for new investments in Syracuse’s hospital infrastructure, some feared the community would be saddled with expensive, duplicate capacity and unnecessary health care costs if the projects planned by both Crouse and University hospitals proceed to completion.

Recent alliance attempts among hospitals have been unsuccessful in addressing the institutions’ financial difficulties and diminishing the need for expanded facilities and services. Crouse and Community General Hospital dissolved a three-year partnership in 2002 after the venture failed to achieve hoped-for savings. This partnership, known as the Health Alliance, consolidated management staff across the two hospital campuses but was unable to integrate clinical services or administrative functions. The resulting arrangement weakened managerial oversight at Community General by moving key staff to the Crouse campus, causing Community General’s administrative operations and financial performance to deteriorate. Both hospitals had problems with billing and collections under the Health Alliance, resulting in a large bad debt write-off.

Progress also stalled on a proposed alliance between Crouse and University that would have allowed the two hospitals to coordinate clinical programs, eliminate unused and redundant capacity and potentially reduce capital construction expenses. The Crouse bankruptcy and the Health Alliance dissolution set off a round of new discussions about a merger or close affiliation between Crouse and University—which are already physically connected—but the discussions ended abruptly. Community leaders suggested several possible reasons for the impasse, including opposition by the Service Employees International Union, which represents nurses and other personnel at Crouse. The union reportedly was concerned about losing influence if University took over Crouse’s services. Another possible obstacle cited by some was the difficulty of finding a mutually acceptable way of combining the two hospitals’ medical staffs.

Hospital competition, centering on profitable services such as cardiology, vascular surgery, orthopedics and obstetrics, has increased over the past two years as integration attempts failed. However, according to most observers, this heightened competition has not given health plans additional leverage in hospital negotiations. Hospitals remain sufficiently differentiated based on reputation, service offerings and physician affiliations, leading employers and consumers to insist on health plan networks that include all four Syracuse hospitals. The financial difficulties at Crouse and other hospitals also have made it increasingly difficult for health plans to negotiate payment concessions from these hospitals.

Despite the heightened competitive environment, all four Syracuse hospitals have continued to pursue collaborative solutions to community-wide health care issues. Over the past two years, hospitals have lowered inpatient lengths of stay and reduced ambulance diversions and emergency room closures.Most recently, the Hospital Executive Council, an association of local hospital leaders, participated with Excellus in an initiative to develop and publicly report hospital-specific measures of patient volume, utilization and outcomes—an effort designed to encourage continued improvements in hospital performance.

Physicians Build New Facilities, Purchase High-Tech Equipment

![]() aced with growing practice expenses and stagnant payment levels, physicians are

pursuing new revenue through ownership of ambulatory surgery centers (ASCs) and

expensive diagnostic imaging equipment, raising questions about the impact of these

acquisitions on health care costs and hospitals’ financial stability. Several new

physician-owned ASCs have opened over the past few years, including facilities for

orthopedic surgery and ophthalmology. Additionally, growing numbers of specialists

have purchased diagnostic equipment for use in their offices, including magnetic resonance imaging (MRI) machines and nuclear imaging cameras.

aced with growing practice expenses and stagnant payment levels, physicians are

pursuing new revenue through ownership of ambulatory surgery centers (ASCs) and

expensive diagnostic imaging equipment, raising questions about the impact of these

acquisitions on health care costs and hospitals’ financial stability. Several new

physician-owned ASCs have opened over the past few years, including facilities for

orthopedic surgery and ophthalmology. Additionally, growing numbers of specialists

have purchased diagnostic equipment for use in their offices, including magnetic resonance imaging (MRI) machines and nuclear imaging cameras.

Owning ASCs and diagnostic equipment allows physicians to control staffing, scheduling and amenities, which they believe increases both patient and physician satisfaction. Moreover, these ventures allow physicians to capture margins from the facility-based payments associated with these services in addition to payment for professional services. These ventures have raised concern that the growth in availability of ambulatory facilities and diagnostic equipment could lead to unnecessary increases in utilization, although in some cases the facilities may be lower-cost alternatives to hospital-based services.

The growth of ASCs was attributed in part to loosening of state certificate-of-need (CON) regulations during the 1990s. New York long maintained one of the nation’s most stringent CON regulatory systems, but the scope and intensity of regulation have decreased considerably since enactment of the state’s Health Care Reform Act of 1996, which also deregulated hospital payments. Diagnostic equipment used in physicians’ offices has remained outside the purview of the CON process. Most recently, state regulators have begun to re-examine the CON process for ASCs, but the likely outcome of this review is unclear.

Hospitals have become increasingly concerned about losing profitable patients and services to physicians. Following the opening of an orthopedic ASC in 2001, Community General Hospital’s outpatient surgery volume declined by 11 percent, according to state statistics. Moreover, both Crouse and St. Joseph’s Hospital expect to lose revenue this year to physician-owned ASCs. Some hospitals have pursued joint ventures with physicians to retain business, but concerns about regulatory limitations and physician-hospital disagreements have prevented some ventures from developing. Although many local physicians continue to participate in one of Syracuse’s two hospital-affiliated independent practice associations, these entities no longer play a significant role in fostering physician-hospital ventures; they function primarily to facilitate physician contracting with health plans.

Concern about long-term cost consequences of the buildup in physician ancillary services has sparked some initial efforts to curb these ventures. Excellus refused to contract with a local orthopedic group’s new ASC in 2001, but the insurer subsequently agreed to do so in 2002, perhaps reflecting the medical group’s increasing market leverage after it merged with several smaller practices. The insurer also refused to contract with a large, local freestanding imaging facility, and it placed a moratorium on contracts with new MRI facilities until the results of a capacity study commissioned in 2002 are available. According to several observers, Excellus has refrained from using more aggressive tactics to curb the buildup in ancillary services because of the considerable community scrutiny it is subject to as the area’s dominant insurer.

Most recently, several Syracuse organizations have begun to discuss establishing a community-wide health planning process that would allow local employers, providers, insurers and other community stakeholders to agree on what health care facilities and technologies should be covered by health plans. This process, modeled after an initiative underway in Rochester, is intended to constrain costs and address perceived weaknesses in the state’s CON system while deflecting provider and consumer complaints that might arise if a single insurer or employer were to adopt these limits on its own. The organizations engaged in the dialogue to date include Excellus, the Metropolitan Development Authority and the Manufacturers’ Association of Central New York. Some area purchasers have agreed to participate in initial discussions, but it is unclear whether the planning process used in Rochester—which enjoys broad support from large employers and other health care stakeholders—can be duplicated successfully in Syracuse.

Public Insurance Expansions and Safety Net Remain Intact

![]() ew York’s recent public insurance expansions have reinforced an already

strong local health care safety net and helped to keep the overall uninsurance rate

in Syracuse relatively low over the past year, despite a modest decline in the local

economy. In 2001 the state implemented Family Health Plus, a new Medicaid

expansion program, which covers uninsured parents earning less than 150 percent of the

federal poverty level and childless adults earning less than 100 percent of poverty

who do not otherwise qualify for Medicaid.

ew York’s recent public insurance expansions have reinforced an already

strong local health care safety net and helped to keep the overall uninsurance rate

in Syracuse relatively low over the past year, despite a modest decline in the local

economy. In 2001 the state implemented Family Health Plus, a new Medicaid

expansion program, which covers uninsured parents earning less than 150 percent of the

federal poverty level and childless adults earning less than 100 percent of poverty

who do not otherwise qualify for Medicaid.

During the same period, the state launched Healthy New York, which provides reduced-cost insurance for uninsured individuals, small businesses and the self-employed. New York also expanded eligibility for the Elderly Pharmaceutical Insurance Coverage (EPIC) program, the state’s pharmacy program for low-income seniors. Collectively, these programs have expanded insurance options significantly for uninsured and underinsured Syracuse residents.

Alongside these insurance expansions, the state and the Syracuse community have moved to boost enrollment in existing sources of public insurance coverage. For example, in 2002 the state simplified and standardized the enrollment and renewal processes for Medicaid and Child Health Plus, New York’s State Children’s Health Insurance Program (SCHIP). In addition, facilitated enrollment, a successful outreach and enrollment process formerly used only for Child Health Plus, was introduced into Medicaid and Family Health Plus in Onondaga County. Under facilitated enrollment, the state contracts with local health departments, health plans and community organizations to help people complete applications for coverage, eliminating the need for people to apply at county social services offices. Syracuse respondents indicated that these state policy changes resulted in significant enrollment increases in public insurance coverage, although the state recently reduced Onondaga County’s funding for facilitated enrollment.

New York’s public insurance expansions, along with stable charity care funding, have helped to reinforce Syracuse’s safety net health care system for the uninsured. As a result, the local safety net has remained financially and organizationally stable, centering on the Syracuse Community Health Center. In addition, all four hospitals play some role in serving the uninsured.

The only major threat to safety net capacity occurred in mid-2002 when St. Joseph’s Hospital announced plans to close the community’s only psychiatric emergency room at the end of the year because of financial losses. This emergency room was originally designed to be a joint venture among three Syracuse hospitals, but two of the hospitals had previously stopped taking patients. In January 2003, the hospitals reached a new agreement to operate and fund the facility jointly.

Access to care has remained stable for most low-income people in Syracuse. Over the past two years, health plan participation in the state’s public insurance programs has grown slightly under increased managed care payments, despite added provider network requirements and quality reporting standards. While provider interest in being a part of these networks has remained strong, physician participation in the fee-for-service Medicaid program reportedly is less adequate due to historically low payment rates, even though the state recently increased these payments. The state also has increased dental payment rates by 250 percent over the past few years, with little success in improving access to dental care. Indeed, dental and mental health services have become very difficult for low-income people in Syracuse to access, particularly because of a shortage of health professionals.

During the past year, large projected budget shortfalls for state and local governments have raised concern about whether health care coverage expansions achieved in Syracuse can be sustained. At the time of the site visit, New York had a $2 billion deficit for the remainder of the fiscal year ending March 31, 2003, and faced a deficit of $10 billion for the next fiscal year. Because local governments are responsible for 15 percent to 25 percent of state Medicaid costs, Onondaga County has shared in the financial strain associated with the recent increases in Medicaid enrollment and expenditures, and the county recently increased property tax rates and offered an early retirement incentive to help avert a budget deficit.

Although Gov. George Pataki has strongly supported the state’s health care programs, his 2003-04 budget proposed more than $1 billion in health care cuts. The proposal included pharmaceutical cost-containment measures in Medicaid and EPIC, a reduction in eligibility for Family Health Plus and the transfer of some children from Medicaid to SCHIP. The governor also proposed adding surcharges on hospitals and other health care providers and reducing Medicaid reimbursement to some providers. In May 2003, however, the Legislature approved a budget (overriding the governor’s vetoes) that raises sales and income taxes and essentially maintains health care spending.

At the same time, the local public health system is balancing its funding priorities. Since the terrorist attacks of Sept. 11, 2001, Syracuse has developed a public health preparedness plan with $1 million in federal funding and strong leadership from the Onondaga County Health Department. However, the recent focus on implementing a smallpox vaccination plan has begun to divert resources and staff from core public health activities, such as West Nile virus prevention and cancer screenings.

Issues to Track

![]() he entry of a competing insurer into Syracuse’s consolidated

health insurance market has offered some employers relief from steep premium

increases in 2003, but the ability to maintain these savings over the longer

term appears to be far from certain. Two of the area’s hospitals are planning

expensive capital projects, and physicians continue to build up costly ancillary

service capacity. Meanwhile, recent expansions in public insurance coverage

have remained largely intact after a round of state budget cutting, but some

observers fear more substantial reductions are on the horizon. Collectively,

these developments raise questions about how health care costs will be contained

in the future to maintain Syracuse’s high rate of insurance coverage and robust

access to care.

he entry of a competing insurer into Syracuse’s consolidated

health insurance market has offered some employers relief from steep premium

increases in 2003, but the ability to maintain these savings over the longer

term appears to be far from certain. Two of the area’s hospitals are planning

expensive capital projects, and physicians continue to build up costly ancillary

service capacity. Meanwhile, recent expansions in public insurance coverage

have remained largely intact after a round of state budget cutting, but some

observers fear more substantial reductions are on the horizon. Collectively,

these developments raise questions about how health care costs will be contained

in the future to maintain Syracuse’s high rate of insurance coverage and robust

access to care.

Key issues to track in the future include:

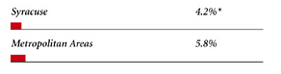

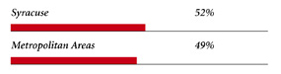

Syracuse Consumers’ Access to Care, 2001

Syracuse compared to metropolitan areas with over 200.000 population

| Unmet Need |

| PERSONS WHO DID NOT GET NEEDED MEDICAL CARE DURING THE LAST 12 MONTHS |

|

| Delayed Care |

| PERSONS WHO DELAYED GETTING NEEDED MEDICAL CARE DURING THE LAST 12 MONTHS |

|

| Out-of-Pocket Costs |

| PRIVATELY INSURED PEOPLE IN FAMILIES WITH OUT-OF-POCKET COSTS OF $500 OR MORE |

|

| Access to Physicians |

| PHYSICIANS WILLING TO ACCEPT ALL NEW PATIENTS WITH PRIVATE INSURANCE |

|

| PHYSICIANS WILLING TO ACCEPT ALL NEW MEDICARE PATIENTS |

|

| PHYSICIANS WILLING TO ACCEPT ALL NEW MEDICAID PATIENTS |

|

| PHYSICIANS PROVIDING CHARITY CARE |

|

| * Site value is significantly different from the mean for large metropolitan

areas over 200,000 population at p<.05. † Indicates a 12-site low. Source: HSC Community Tracking Study Household and Physician Surveys, 2000-01 Note: If a person reported both an unmet need and delayed care, that person is counted as having an unmet need only. Based on follow-up questions asking for reasons for unmet needs or delayed care, data include only responses where at least one of the reasons was related to the health care system. Responses related only to personal reasons were not considered as unmet need or delayed care. |

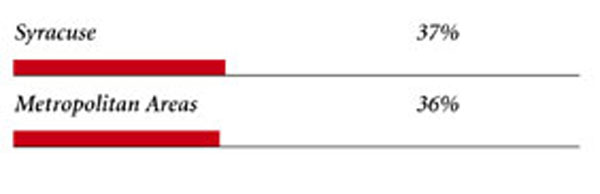

Background and Observations

| Syracuse Demographics | |

| Syracuse | Metropolitan areas 200,000+ population |

| Population1 731,252 |

|

| Persons Age 65 or Older2 | |

| 13% | 11% |

| Median Family Income2 | |

| $32,738 | $31,883 |

| Unemployment Rate3 | |

| 5.5% | 5.8%* |

| Persons Living in Poverty2 | |

| 9.6% | 12% |

| Persons Without Health Insurance2 | |

| 8.0% | 13% |

| Age-Adjusted Mortality Rate per 1,000 Population4 | |

| 8.7 | 8.8* |

* National average. Sources: |

|

| Health Care Utilization | |

| Syracuse | Metropolitan areas 200,000 population |

| Adjusted Inpatient Admissions per 1,000 Population 1 | |

| 150 | 180 |

| Persons with Any Emergency Room Visit in Past Year 2 | |

| 18% | 19% |

| Persons with Any Doctor Visit in Past Year 2 | |

| 83% | 78% |

| Average Number of Surgeries in Past Year per 100 Persons 2 | |

| 20 | 17 |

| Sources: 1. American Hospital Association, 2000 2. HSC Community Tracking Study Household Survey, 2000-01 |

|

| Health System Characteristics | |

| Syracuse | Metropolitan areas 200,000+ population |

| Staffed Hospital Beds per 1,000 Population1 | |

| 2.2 | 2.5 |

| Physicians per 1,000 Population2 | |

| 2.0 | 1.9 |

| HMO Penetration, 19993 | |

| 21% | 38% |

| HMO Penetration, 20014 | |

| 17% | 37% |

| Medicare-Adjusted Average per Capita Cost (AAPCC) Rate, 20025 | |

| $553 | $575 |

| Sources: 1. American Hospital Association, 2000 2. Area Resource File, 2002 (includes nonfederal, patient care physicians, except radiologists, pathologists and anesthesiologists) 3. InterStudy Competitive Edge, 10.1 4. InterStudy Competitive Edge, 11.2 5. Centers for Medicare and Medicaid Services. Site estimate is payment rate for largest county in site; national estimate is national per capita spending on Medicare enrollees in Coordinated Care Plans in December 2002. |

|