Data Bulletin No. 29

June 2005

Bradley C. Strunk, Paul B. Ginsburg, John P. Cookson

![]() he recent slowdown in health care spending growth leveled

off in 2004 as health care costs per privately insured American increased 8.2

percent in 2004—virtually the same rate of increase as in 2003. Nonetheless,

health spending growth continued to outpace overall economic growth by a wide

margin—2.6 percentage points—in 2004, despite a robust 5.6 percent increase

in the overall U.S. economy as measured by per capita gross domestic product

(see Table 1).

he recent slowdown in health care spending growth leveled

off in 2004 as health care costs per privately insured American increased 8.2

percent in 2004—virtually the same rate of increase as in 2003. Nonetheless,

health spending growth continued to outpace overall economic growth by a wide

margin—2.6 percentage points—in 2004, despite a robust 5.6 percent increase

in the overall U.S. economy as measured by per capita gross domestic product

(see Table 1).

If health care spending growth continues to exceed growth in workers’ incomes by a significant margin, health insurance will become unaffordable to more and more people.

Table 1

|

|||||||

|

Change in Spending on Type of Health Care Service

|

|||||||

| Year |

All Services

|

Hospital Inpatient

|

Hospital Outpatient

|

Physician

|

Rx Drugs

|

Other

|

GDP

|

| 1994 |

3.5%

|

-2.3%

|

8.0%

|

2.1%

|

5.1%

|

12.3%

|

4.9%

|

| 1995 |

4.2

|

-3.7

|

7.0

|

2.6

|

10.7

|

8.6

|

3.4

|

| 1996 |

4.2

|

-4.6

|

7.0

|

2.2

|

10.8

|

12.0

|

4.4

|

| 1997 |

5.6

|

-5.4

|

8.9

|

4.1

|

11.4

|

11.8

|

5.0

|

| 1998 |

7.1

|

0.0

|

7.7

|

5.6

|

13.6

|

7.6

|

4.1

|

| 1999 |

9.9

|

2.6

|

11.6

|

6.7

|

18.1

|

5.5

|

4.8

|

| 2000 |

9.3

|

4.0

|

9.8

|

7.7

|

14.2

|

4.4

|

4.8

|

| 2001 |

11.3

|

8.6

|

14.5

|

7.8

|

13.5

|

9.1

|

2.1

|

| 2002 |

10.7

|

8.2

|

13.0

|

7.9

|

13.1

|

6.2

|

2.5

|

| 2003 |

8.4

|

6.1

|

11.1

|

6.4

|

8.9

|

5.8

|

3.9

|

| 2004 |

8.2

|

6.2

|

11.3

|

6.4

|

7.2

|

6.0

|

5.6

|

| Notes: GDP is in nominal dollars. Estimates

differ from past reports due to data revisions by Milliman and the Bureau

of Economin Analysis. Source: Health care spending data are the Milliman health Cost Index ($0 deductible). Gross Domestic Product is from the U.S. Department of Commerce, Bureau of Economic Analysis. |

|||||||

After peaking at 11.3 percent in 2001, health care spending growth slowed in 2002 and 2003 but now has leveled off at a relatively high rate. Trends in four of the five spending categorie—inpatient and outpatient hospital care, physician services, and other services—stabilized in 2004, while prescription drug spending grew at a slower rate for the fifth year in a row.

Meanwhile, the slowdown in employer-sponsored health insurance premium growth continued, with 2005 average premium increases estimated to range between 8 percent and 10 percent, down from 12 percent in 2004. The continued slowdown in premium trend likely reflects the lagged relationship between underlying health spending trends and premium trends.

In recent years employers have increased patient cost sharing, through higher deductibles, copayments and coinsurance, as a way to cope with double-digit premium increases. This trend appears to have continued in 2005 for the fourth year in a row, although to a lesser degree than in recent years.

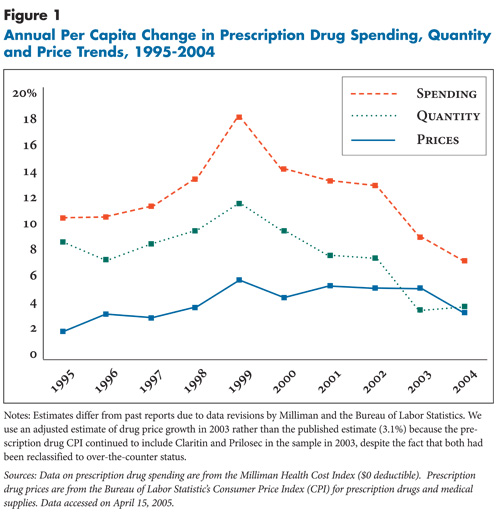

Prescription drugs. For the fifth year in a row, prescription drug spending per privately insured person increased at a slower pace, growing 7.2 percent in 2004—compared with 8.9 percent in 2003 and less than half the 1999 peak increase of 18.1 percent. The slowdown in 2004 was largely a result of slower growth in drug prices rather than changes in the growth of drug utilization (see Figure 1). Prescription drug spending accounted for 21 percent of the overall total spending increase in 2004.

Hospital spending. Spending on inpatient services increased 6.2 percent in 2004, essentially unchanged from the 6.1 percent increase in 2003. Spending on outpatient care increased 11.3 percent—keeping it the fastest growing category of health spending for the fourth year in a row—compared with 11.1 percent in 2003. The outpatient hospital category includes spending for services provided in freestanding facilities, such as surgery centers and imaging centers. Taken together, spending growth on inpatient and outpatient care accounted for 54 percent of the total increase in health spending in 2004.

After slowing sharply in 2003, the hospital utilization trend increased somewhat in 2004, growing 2.9 percent. But hospital price growth—for inpatient and outpatient care combined—slowed for the first time in seven years in 2004, albeit at a relatively high rate of 7 percent.

Physician care. Spending on physician care increased 6.4 percent in 2004, identical to the 2003 growth rate. There was a small decline in the growth rate for use of physician services, while growth in prices for physician services increased slightly. Growth in spending on physician services accounted for 24 percent of the total increase in spending growth.

Other services. Spending on other types of services—most notably home health care and ambulance services—grew 6 percent in 2004 and accounted for about 2 percent of the overall increase in spending growth.

![]() nfortunately, the good news of a year

ago that health care cost trends had finally

slowed has now been replaced by the bad

news that trends stabilized in 2004 at a

relatively high rate of growth.

nfortunately, the good news of a year

ago that health care cost trends had finally

slowed has now been replaced by the bad

news that trends stabilized in 2004 at a

relatively high rate of growth.

The forces brewing in today’s health care system are varied, with some—drug safety issues and patent expirations, for example—suggesting decreasing cost trends, but others—booming capital spending by hospitals and physician-owned facilities—suggesting increases. An assessment of the health care landscape indicates that cost trends are likely to remain close to the high growth rate of 2004 for the next few years.

The ongoing march of medical technology—some extremely beneficial and some that is of more questionable value—means that cost trends are unlikely to ever be much lower than the growth in income for more than a brief interval unless more meaningful cost-containment measures are taken.

Indeed, a magic cost-containment bullet remains elusive, leaving Americans to confront the sobering knowledge that continued health care cost growth in excess of growth in workers’ incomes will lead to more uninsured people. Although there is no clear consensus among policy makers and major stakeholders in this country about how best to control health costs, the imperative to continue that debate and act in some fashion remains as high as ever.