Increased Consolidation Raises Concerns

Cleveland, Ohio

Community Report No. 02

Fall 2000

Jon B. Christianson, Cara S. Lesser, Laurie E. Felland, Suzanne Felt-Lisk, Paul B. Ginsburg, Alison K. Vratil, Elizabeth Eagan

Over the past two years, Cleveland witnessed the departure of two for-profit hospital chains that had been in the area since 1994, leading to significant organizational change. Two inner-city hospitals were closed, and, through a series of recent acquisitions, the Cleveland Clinic Health System (CCHS) and the University Hospitals Health System (UHHS), two local, not-for-profit hospital systems, have strengthened their dominance in the Cleveland market.

Other noteworthy developments include:

- CCHS and UHHS are strengthening their

links with physicians, and independent physicians in Cleveland face growing

pressures to align more closely with them.

- Health plans believe that, because

of the growing dominance of CCHS and UHHS, they have lost power in their negotiations

with providers.

- Employers have experienced double-digit premium increases

from health plans and have abandoned a nationally known, decade-long hospital

quality initiative.

- Health plan and provider resistance to contracting with Medicaid managed care has stiffened, while inner-city hospital closures have raised concerns about access to care for the low-income uninsured.

- Two Hospital Systems Strengthen Their Market Dominance

- Systems Put Pressure on Physicians and Plans

- Commercial Health Plan Market Remains Stable

- Employers’ Influence Declines

- Face-Off Looming in Medicaid Managed Care

- Hospital Closures Raise Safety Net Concerns

- Issues to Track

- Cleveland’s Experience with the Local Health System, 1997 and 1999

- Background and Observations

Two Hospital Systems Strengthen Their Market Dominance

The two leading local systems, CCHS and UHHS, saw their market shares increase considerably as a result of these changes. Shortly after the for-profit systems had entered the market, both local systems began a round of acquisitions and affiliations to bolster their positions; by 1998, CCHS and UHHS dominated the Cleveland market. With recent additions from the fallout of Columbia’s and PHS’s departures, CCHS and UHHS strengthened their positions further, as each added new holdings.

- UHHS acquired Columbia’s 50 percent

ownership of the Cleveland area Sisters

of Charity hospitals, adding more than

600 beds.

- UHHS also acquired two of the former

PHS hospitals, St. Michael Hospital and

Mount Sinai East (renamed Richmond

Heights), after a contentious battle with

CCHS, which sought to purchase and

close these facilities (a move UHHS

viewed as an effort to block it from

establishing a presence in these areas,

particularly in the affluent and densely

populated neighborhood where Mount

Sinai East was located).

- CCHS secured the Beachwood Integrated Medical Campus, an ambulatory care site formerly owned by PHS.

The two systems are locked in fierce competition over service lines and geographic presence, particularly in Cleveland’s suburbs, where a bricks and mortar war has emerged. The systems also have begun to expand their reach more aggressively outside of Cleveland, strengthening ties to hospitals in Akron, Youngstown and Canton.

Most recently, there are signs that the two systems’ jockeying has the potential to expand into a cap and gown war. CCHS has announced plans to terminate its relationship with Ohio State University Medical School and is considering establishing its own school, while UHHS has moved to revamp its existing relationship with Case Western Reserve Medical School and plans to establish its own research facility. The impact of these various initiatives on the proliferation of services and physicians in the market- and their implications for local health care costs-remains to be seen.

Systems Put Pressure on Physicians and Plans

Cleveland area health plans, in turn, report that they have less influence in negotiations with providers, and less ability to resist providers’ payment demands, than they had in 1998. CCHS and UHHS have had some successes recently in getting health plans to pay higher rates, and both systems have begun to eliminate contracts with low reimbursement. CCHS, in particular, has soured on risk contracting- arguing that payment rates to providers under risk contracts have been too low, and that gatekeeping requirements have been difficult to implement effectively- and it is now pursuing a strategy to eliminate all risk contracting from its system.

Despite these signs of the systems’ increased clout with health plans, providers contend that plans maintain the upper hand in contract negotiations. For example, respondents point to Aetna’s success in getting virtually all of its providers to sign contracts that require them to participate in all of its products, despite providers’ strong initial resistance to such terms.

Commercial Health Plan Market Remains Stable

Meanwhile, there has been little growth in HMO enrollment among the commercially insured. In the tight labor market, many employers in Cleveland continue to offer their employees health plan products with a broad choice of providers and relatively few barriers to access to providers. Enrollment in health plans’ preferred provider organization (PPO) products, and in point-of-service (POS) offerings with minimal gatekeeping requirements, has been growing.

To facilitate enrollees’ access to specialists, and to reduce administrative demands on physicians, some health plans recently changed their utilization management procedures, focusing primarily on scaling back or revamping their prior approval processes. Some employers in Cleveland have expressed concern that such changes could prove costly, further driving up premiums.

Employers’ Influence Declines

One employer organization in Cleveland that has had some success in constraining premium increases during the past two years is the Council of Small Employers (COSE), a private organization formed in the early 1970s by the Chamber of Commerce. COSE, which provides health insurance to 214,000 enrollees affiliated with 13,371 firms, reportedly had premium increases of 7.5 percent in 1999 and 7.25 percent in 2000. The organization attributes its relative success in this regard to strict medical underwriting in the past, careful design of benefits and a long-standing relationship with a single insurer, Medical Mutual of Ohio, where it has concentrated enrollment and, thus, has more leverage in negotiations.

Health purchasers in Cleveland are proud of the national reputation of CCHS and UHHS. Even so, many employers fear that product-line competition between the two hospital systems eventually will drive up costs of employee benefits. Some also fear that CCHS and UHHS will be able to exploit their market power to the disadvantage of health plans and employers.

So far, Cleveland employers have been getting mixed signals about the willingness of CCHS and UHHS to support their agendas as health care purchasers. UHHS, for example, is using its 10- to 15- member corporate advisory board for its health plan, QualChoice, to communicate new customer service initiatives and elicit feedback from some of its largest customers- a move that has been well-received by employers.

On the other hand, some employers blame CCHS for the recent demise of Cleveland Health Quality Choice (CHQC), a nationally known, decade-long program that provided comparative data on hospitals to health purchasers and consumers. Many Cleveland hospitals had complained that their performance was not portrayed accurately in CHQC’s comparisons. When CHQC tried to expand its comparisons to include price and quality, CCHS increased its opposition and finally withdrew from the process. CCHS said that it saw little reason to continue incurring the expense of assembling the information, because CHQC’s risk-adjustment approach was inadequate, and there was no evidence that purchasers were using the hospital performance data in making decisions.

Cleveland’s experience with CHQC illustrates some of the difficulties in managing a voluntary, community-level effort to develop comparative data on provider costs and quality. Some respondents point to the timing of CCHS’s withdrawal as evidence of its growing market power. Others say the demise of the quality initiative was inevitable, however, noting that support for the initiative had already diminished, particularly among employers that contract with national managed care plans to serve their employees with an established networks of providers.

Face-off Looming in Medicaid Managed Care

Two years ago, multiple health plans participated in Medicaid managed care, but several were having financial difficulties, and withdrawals were on the horizon. Now only four health plans contract with Medicaid in Cuyahoga County-Medical Mutual, QualChoice and two plans that were acquired recently after poor financial performance: Emerald (acquired by Renaissance) and Total Health (acquired by Dayton Area Health Plan). No new health plans in Cleveland have submitted bids to provide managed care to Medicaid beneficiaries in the upcoming contract cycle, despite Ohio’s efforts to respond to plans’ complaints about payment rates with increases of 9 percent in January 2000 and another 6 percent in July 2000.

To remain financially viable, most Medicaid managed care plans in Cuyahoga County have attempted to shift risk to providers, which has strained providers financially. In fact, the largest Medicaid provider in the state, MetroHealth System, has threatened to withdraw from Medicaid in February 2001 if it cannot reach an acceptable payment agreement with the federal plan. MetroHealth- Cuyahoga County’s public hospital system-is a critical component of Medicaid’s managed care program in Cleveland. Market observers note that without MetroHealth’s participation, most health plans would be hard-pressed to remain in Medicaid managed care in Cuyahoga County. MetroHealth is now negotiating with the Ohio Department of Job and Family Services for a direct contracting arrangement that could change dramatically the way Medicaid services are financed and organized in the Cleveland market.

Hospital Closures Raise Safety Net Concerns

The closing of Mount Sinai Hospital, located in a low-income area of Cleveland’s East Side, reportedly created problems regarding access to outpatient and emergency services. Some uninsured patients who were previously served by the hospital now seek services from MetroHealth, but other patients reportedly face difficulties negotiating Cleveland’s transportation system to access care there. At about the same time, inpatient beds at St. Luke’s Medical Center, one of the three Sisters of Charity hospitals, were eliminated, closing down what was once the second largest provider of inpatient charity care in Cleveland, after MetroHealth. A significant proportion of St. Luke’s inpatient volume has been absorbed by St. Vincent Charity Hospital, a move that reportedly improved the financial condition of both institutions. However, restructuring of these services has added to concerns about access to care for low-income uninsured in Cleveland.

On a positive note, local providers and politicians are optimistic that Healthy Start, Ohio’s Children’s Health Insurance Program, will help to diminish the ranks of the uninsured in Cleveland. Local outreach and enrollment efforts have been successful to date, and expansions of coverage for children and some parents are expected to boost enrollment further this year.

However, because Healthy Start is structured as an expansion of Medicaid, providers have expressed concern that the program will be plagued by the same problems experienced under Medicaid managed care. In addition, some providers worry that expanded insurance coverage might lead to reduced funding for uncompensated care, threatening a net decrease in total revenue for patient care. Cleveland’s community health centers are especially apprehensive, because their financial condition reportedly has deteriorated over the past two years due to declining reimbursement and contracting challenges under Medicaid managed care.

Concerns about the state of the local safety net and the troubles confronting Medicaid managed care over the last two years have focused the Cleveland community on access to care for low-income and uninsured residents. U.S. Representative Dennis Kucinich (D), Cuyahoga County commissioners and the mayor of Cleveland all have become actively involved in these issues. Local health departments, elected officials, foundations and consumer advocates are undertaking a variety of steps to assess and improve access to primary care and create programs to link people in need to available services.

Issues to Track

All of these developments suggest several issues to track in Cleveland:

- How will CCHS and UHHS choose

to exercise their increased clout in

the market? Will the remaining independent

physicians be able to resist

pressures to affiliate with the systems?

- Will the popularity of PPOs and other

similar health plans continue in the face

of rising premiums? What steps will

purchasers take to manage their rising

health care costs, in light of tight labor

markets?

- How will Medicaid respond to provider

protests about low reimbursements

from managed care plans?

- Will recent community attention to safety net issues translate into increased funding and new programs?

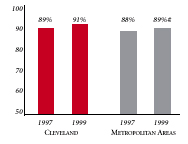

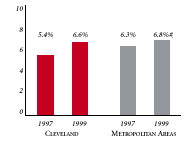

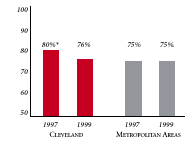

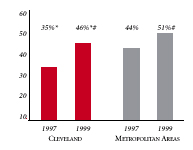

Cleveland’s Experience with the Local Health System, 1997 and 1999

| PERSONS SATISFIED WITH THE HEALTH CARE THEY RECEIVED IN THE LAST 12 MONTHS | PERSONS WHO DID NOT GET NEEDED MEDICAL CARE IN THE LAST 12 MONTHS |

|

|

| PHYSICIANS AGREEING THAT IT IS POSSIBLE TO PROVIDE HIGH-QUALITY CARE TO THEIR PATIENTS | PERSONS WITH INSURANCE THAT REQUIRES GATEKEEPING |

|

|

|

* Site value is significantly different from the mean for metropolitan areas over 200,000 population. # Statistically significant difference between 1997 and 1999 at p< .05. The information in these graphs comes from the Household and Physician Surveys conducted in 1996-1997 and 1998-1999 as part of HSC’s Community Tracking Study. |

|

Background and Observations

| Cleveland Demographics | |

| Cleveland | Metropolitan areas above 200,000 population |

| Population, July 1, 19991 2,221,181 |

|

| Population Change, 1990-19992 | |

| 0.9% | 8.6% |

| Median Income3 | |

| $26,840 | $27,843 |

| Persons Living in Poverty3 | |

| 13% | 14% |

| Persons Age 65 or Older3 | |

| 15% | 11% |

| Sources: 1. US Bureau of Census, 1999 Community Population Estimates 2. US Bureau of Census, 1990 & 1999 Community Population Estimates 3. Community Tracking Study Household Survey, 1998-1999 |

|

| Health Insurance Status | |

| Cleveland | Metropolitan areas above 200,000 population |

| Persons under Age 65 with No Health Insurance1 | |

| 8.6% | 15% |

| Children under Age 18 with No Health Insurance1 | |

| 5.9% | 11% |

| Employees Working for Private Firms that Offer Coverage2 | |

| 90% | 84% |

| Average Monthly Premium for Self-Only Coverage under Employer-Sponsored Insurance2 | |

| $163 | $181 |

| Sources: 1. Community Tracking Study Household Survey, 1998-1999 2. Robert Wood Johnson Foundation Employer Health Insurance Survey, 1997 |

|

| Health System Characteristics | |

| Cleveland | Metropolitan areas above 200,000 population |

| Staffed Hospital Beds per 1,000 Population1 | |

| 3.6 | 2.8 |

| Physicians per 1,000 Population2 | |

| 2.7 | 2.3 |

| HMO Penetration, 19973 | |

| 27% | 32% |

| HMO Penetration, 19994 | |

| 29% | 36% |

| Sources: 1. American Hospital Association, 1998 2. Area Resource File, 1998 (includes nonfederal, patient care physicians, except radiologists, pathologists and anesthesiologists) 3. InterStudy Competitive Edge 8.1 4. InterStudy Competitive Edge 10.1 |

|

The Community Tracking Study, the major effort of the Center for Studying Health System Change (HSC), tracks changes in the health system in 60 sites that are representative of the nation. Every two years, HSC conducts surveys in all 60 communities and site visits in 12 communities. The Community Report series documents the findings from the third round of site visits. Analyses based on site visit and survey data from the Community Tracking Study are published by HSC in Issue Briefs, Data Bulletins and peer-reviewed journals. These publications are available at www.hschange.org.

Jon B. Christianson, University of Minnesota

Cara S. Lesser, HSC

Laurie Felland, HSC

Sue Felt-Lisk, Mathematica Policy Research, Inc.

Paul B. Ginsburg, HSC

Alison K. Vratil, HSC

Elizabeth Eagan, HSC

President: Paul B. Ginsburg

Director of Site Visits: Cara S. Lesser

Director of Public Affairs: Ann C. Greiner

Editor: The Stein Group