Insurance Coverage & Costs

Access to Care

Quality & Care Delivery

Health Care Markets

Insurance Coverage & Costs

Access to Care

Quality & Care Delivery

Health Care Markets

Issue Briefs

Data Bulletins

Research Briefs

Policy Analyses

Community Reports

Journal Articles

Other Publications

Surveys

Site Visits

Design and Methods

Data Files

|

Insurers Consolidate, Hospitals Struggle Financially

Syracuse, New York

Community Report No. 05

Winter 2001

Aaron Katz, Robert E. Hurley, Leslie A. Jackson, Timothy K. Lake, Ashley C. Short, James D. Reschovsky

n October 2000, a team of researchers

visited Syracuse, N.Y., to study that

community’s health system, how it is

changing and the effects of those

changes on consumers. The Center for

Studying Health System Change

(HSC), as part of the Community

Tracking Study, interviewed more than

60 leaders in the health care market.

Syracuse is one of 12 communities

tracked by HSC every two years

through site visits and surveys.

Individual community reports are

published for each round of site visits.

The first two site visits to Syracuse, in

1996 and 1998, provided baseline and

initial trend information against

which changes are tracked. The

Syracuse market includes Cayuga,

Madison, Onondaga and Oswego

counties. n October 2000, a team of researchers

visited Syracuse, N.Y., to study that

community’s health system, how it is

changing and the effects of those

changes on consumers. The Center for

Studying Health System Change

(HSC), as part of the Community

Tracking Study, interviewed more than

60 leaders in the health care market.

Syracuse is one of 12 communities

tracked by HSC every two years

through site visits and surveys.

Individual community reports are

published for each round of site visits.

The first two site visits to Syracuse, in

1996 and 1998, provided baseline and

initial trend information against

which changes are tracked. The

Syracuse market includes Cayuga,

Madison, Onondaga and Oswego

counties.

After a flurry of competitive maneuvering in 1997-1998 in anticipation of managed

care growth, the Syracuse health care market has settled into an uneasy calm,

as consolidation among local insurers has muted concerns that aggressive managed

care will take hold. Indeed, a series of health plan exits and mergers have left

indemnity insurer Excellus Blue Cross Blue Shield with about 40 percent of the

Syracuse market, which has produced a new stabilizing force in the local market.

Nevertheless, hospitals have struggled financially in face of reduced payment

rates, operational problems and long-term debt.

Other developments in Syracuse include the following:

- Under mounting financial pressure, the largest local

hospital system has filed for bankruptcy, while it and

others are taking steps to cut costs.

- Physicians are increasingly concerned about how they

will be affected by the growing clout of Excellus.

- New York State has continued to expand access to

health insurance and strengthen the local safety net.

Health Plan Shakeout Leaves One Dominant Indemnity Insurer

ven the limited presence and influence

of managed care in the Syracuse market

appears to be diminishing. In a market

where hospital rate regulation and lack

of employer interest stymied the growth

of managed care products for many years,

Syracuse has long been a bastion of

indemnity insurance. Since 1998, plans

with tight managed care products have

downgraded their activities in Syracuse,

left the market entirely or been absorbed

by Excellus.

The most dramatic of these developments came in late 2000, when Excellus announced

plans to acquire Univera, the largest health maintenance organization (HMO) in

Syracuse, with 130,000 members. Univera was formed in the late 1990s from a merger

of HealthCarePlan of Buffalo and PHP, the latter a product of the national HMO

movement that began in the 1970s. The acquisition of Univera by Excellus will

bring an estimated 40 percent of the Syracuse market under one insurer.

Even before the Excellus-Univera deal

was announced, plan exits and reconfigurations

had reduced managed care options

in Syracuse. CIGNA withdrew its HMO

product from the market, remaining

largely to provide looser products to

major national accounts. Kaiser left the

Northeast altogether. North Medical

Community Health Plan, a local HMO

developed by a physician-entrepreneur,

sold out to Excellus because of increasing

financial difficulties. United Healthcare

consolidated its central New York operations

with those in New York City and

downgraded its Syracuse operations to a

submarket. And Aetna’s attempt to launch

an HMO product in this market has stalled,

reportedly because of the firm’s inability to

form an adequate provider network.

The Syracuse market appears to have

embraced consolidation among insurers

as an antidote to the competitive pressures that were unleashed in the aftermath

of New York State’s 1996 deregulation of

hospital rates. This transition from one

form of stability to another has been

relatively easy because of the regulatory heritage

in New York and the general antipathy

for outside, for-profit health plans.

Managed care penetration in the Syracuse market-including preferred provider organizations

(PPOs), which state laws had prohibited until the late 1990s-is now less than

40 percent. Moreover, the area’s moderate HMO enrollment has been migrating to

point-of- service (POS) and PPO products. Managed care’s weakness in Syracuse

is typified by the experience of Blue Cross Blue Shield of Central New York. This

Excellus subsidiary has grown approximately 20 percent since the Excellus acquisition

two years ago, mainly in its indemnity and PPO/POs products.

Neither purchasers nor consumers

have displayed much interest in HMOs

or other tight managed care products.

Unlike employers in nearby Rochester

and Buffalo that have long supported

community-rated HMOs, Syracuse

employers have favored open network

products and initiated few efforts to

influence either costs or quality in the

market. More than two-thirds of Excellus’

business is in its traditional indemnity

products, which have the advantages of a

broad network PPO, such as wide choice

and open access, and few disadvantages

from a consumer perspective. Moreover,

with considerable leverage over providers,

Excellus has displayed little interest in

downstreaming risk to promote managed

care incentives. ven the limited presence and influence

of managed care in the Syracuse market

appears to be diminishing. In a market

where hospital rate regulation and lack

of employer interest stymied the growth

of managed care products for many years,

Syracuse has long been a bastion of

indemnity insurance. Since 1998, plans

with tight managed care products have

downgraded their activities in Syracuse,

left the market entirely or been absorbed

by Excellus.

The most dramatic of these developments came in late 2000, when Excellus announced

plans to acquire Univera, the largest health maintenance organization (HMO) in

Syracuse, with 130,000 members. Univera was formed in the late 1990s from a merger

of HealthCarePlan of Buffalo and PHP, the latter a product of the national HMO

movement that began in the 1970s. The acquisition of Univera by Excellus will

bring an estimated 40 percent of the Syracuse market under one insurer.

Even before the Excellus-Univera deal

was announced, plan exits and reconfigurations

had reduced managed care options

in Syracuse. CIGNA withdrew its HMO

product from the market, remaining

largely to provide looser products to

major national accounts. Kaiser left the

Northeast altogether. North Medical

Community Health Plan, a local HMO

developed by a physician-entrepreneur,

sold out to Excellus because of increasing

financial difficulties. United Healthcare

consolidated its central New York operations

with those in New York City and

downgraded its Syracuse operations to a

submarket. And Aetna’s attempt to launch

an HMO product in this market has stalled,

reportedly because of the firm’s inability to

form an adequate provider network.

The Syracuse market appears to have

embraced consolidation among insurers

as an antidote to the competitive pressures that were unleashed in the aftermath

of New York State’s 1996 deregulation of

hospital rates. This transition from one

form of stability to another has been

relatively easy because of the regulatory heritage

in New York and the general antipathy

for outside, for-profit health plans.

Managed care penetration in the Syracuse market-including preferred provider organizations

(PPOs), which state laws had prohibited until the late 1990s-is now less than

40 percent. Moreover, the area’s moderate HMO enrollment has been migrating to

point-of- service (POS) and PPO products. Managed care’s weakness in Syracuse

is typified by the experience of Blue Cross Blue Shield of Central New York. This

Excellus subsidiary has grown approximately 20 percent since the Excellus acquisition

two years ago, mainly in its indemnity and PPO/POs products.

Neither purchasers nor consumers

have displayed much interest in HMOs

or other tight managed care products.

Unlike employers in nearby Rochester

and Buffalo that have long supported

community-rated HMOs, Syracuse

employers have favored open network

products and initiated few efforts to

influence either costs or quality in the

market. More than two-thirds of Excellus’

business is in its traditional indemnity

products, which have the advantages of a

broad network PPO, such as wide choice

and open access, and few disadvantages

from a consumer perspective. Moreover,

with considerable leverage over providers,

Excellus has displayed little interest in

downstreaming risk to promote managed

care incentives.

Hospitals Struggle Under Growing Financial Pressures

he financial condition of Syracuse hospitals

has worsened over the past two

years, culminating with the February

2001 bankruptcy filing by the largest

hospital system. The 566-bed Crouse

Hospital filed for Chapter 11 bankruptcy

protection after facing declining payment

from both public and private payers and

more than $90 million in long-term debt.

The hospital had recently joined forces

with Community General Hospital in an

effort to gain operational efficiencies.

Under a parent holding company called

the Health Alliance of Central New York,

the two hospitals had embarked on a

number of cost-cutting initiatives to

address mounting losses at both facilities.

However, the two hospitals did not merge

assets and remain distinct facilities operating

under their original names, without

consolidating the clinical services offered

by each institution. Under its bankruptcy

protection request, Crouse Hospital

maintains that no services will be closed

and that patient care will go uninterrupted

during the restructuring. Rather, Crouse

views this action as necessary to obtain

relief from creditors while reorganizing

its finances.

Meanwhile, Syracuse’s other major hospitals also have experienced financial woes,

dampening their long-standing collaborative spirit as hospitals focus on improving

their bottom lines. Though area hospitals continue to work together on quality

and disease management issues through a collaborative group called the Hospital

Executive Council, these issues have become less pressing, while competitive pressures

have mounted. Fueled by the deregulation of hospital rates in 1996 and expectations

of growing HMO penetration and provider risk-sharing, Syracuse hospitals prepared

cautiously in 1997-1998 to negotiate competitive rates with health plans by cutting

costs and exploring alliances. Two years later, however, this activity has resulted

in little change in the structure of the local hospital market, and Syracuse hospitals

remain focused largely on internal operational issues.

Like Crouse and Community hospitals,

Syracuse’s two other major hospitals-

St. Joseph’s Hospital and University

Hospital-have not embarked on any

major initiatives to increase market

share, revenue or clout since 1998. Instead,

facing budget deficits and Medicare

payment reductions, the hospitals have

focused on cutting costs, reducing outpatient

services and programs and enhancing

inpatient clinical capacity in areas of historic

strength. St. Joseph’s, for example,

has cut operating costs in its outpatient

clinics, which serve many low-income

individuals, to keep the clinics open,

while University Hospital reduced staff

by 300 full-time equivalents (FTEs) over

the past few years, which helped it to

avoid red ink in 1999.

The effects of Medicare payment

cuts on Syracuse hospitals have been

exacerbated by a growing shortage of

nurses. All four hospitals have significant

nursing staff vacancies, which limit their

inpatient and outpatient capacity and

thus their ability to generate revenue.

An ongoing emergency room diversion

program-which directs ambulances to

a hospital with available inpatient beds-

has gained importance as hospitals’ ability

to staff units has eroded. This program

stands as an important remnant of

hospitals’ collaborative approach to

community health problems.

As in the past, there is some

sentiment among local observers that

Syracuse has too many hospitals-and

the Crouse/Community General alliance

has not dramatically changed the Syracuse

hospital environment in this regard.

Local observers disagree about whether

or when a hospital closure might actually

occur, and if it does, which hospital

would close.

Five smaller community hospitals

serve the suburban counties outside of

Syracuse. Neither these community hospitals

nor the four Syracuse hospitals have

sought formal alliances to shore up referral

networks or otherwise expand market

share the way hospitals in other markets

have. The reason may be that the suburban

hospitals are sole community providers

that have considerable bargaining clout

with insurers, and the city hospitals are

satisfied with the referrals and transfers

that they now receive from outside

Syracuse. he financial condition of Syracuse hospitals

has worsened over the past two

years, culminating with the February

2001 bankruptcy filing by the largest

hospital system. The 566-bed Crouse

Hospital filed for Chapter 11 bankruptcy

protection after facing declining payment

from both public and private payers and

more than $90 million in long-term debt.

The hospital had recently joined forces

with Community General Hospital in an

effort to gain operational efficiencies.

Under a parent holding company called

the Health Alliance of Central New York,

the two hospitals had embarked on a

number of cost-cutting initiatives to

address mounting losses at both facilities.

However, the two hospitals did not merge

assets and remain distinct facilities operating

under their original names, without

consolidating the clinical services offered

by each institution. Under its bankruptcy

protection request, Crouse Hospital

maintains that no services will be closed

and that patient care will go uninterrupted

during the restructuring. Rather, Crouse

views this action as necessary to obtain

relief from creditors while reorganizing

its finances.

Meanwhile, Syracuse’s other major hospitals also have experienced financial woes,

dampening their long-standing collaborative spirit as hospitals focus on improving

their bottom lines. Though area hospitals continue to work together on quality

and disease management issues through a collaborative group called the Hospital

Executive Council, these issues have become less pressing, while competitive pressures

have mounted. Fueled by the deregulation of hospital rates in 1996 and expectations

of growing HMO penetration and provider risk-sharing, Syracuse hospitals prepared

cautiously in 1997-1998 to negotiate competitive rates with health plans by cutting

costs and exploring alliances. Two years later, however, this activity has resulted

in little change in the structure of the local hospital market, and Syracuse hospitals

remain focused largely on internal operational issues.

Like Crouse and Community hospitals,

Syracuse’s two other major hospitals-

St. Joseph’s Hospital and University

Hospital-have not embarked on any

major initiatives to increase market

share, revenue or clout since 1998. Instead,

facing budget deficits and Medicare

payment reductions, the hospitals have

focused on cutting costs, reducing outpatient

services and programs and enhancing

inpatient clinical capacity in areas of historic

strength. St. Joseph’s, for example,

has cut operating costs in its outpatient

clinics, which serve many low-income

individuals, to keep the clinics open,

while University Hospital reduced staff

by 300 full-time equivalents (FTEs) over

the past few years, which helped it to

avoid red ink in 1999.

The effects of Medicare payment

cuts on Syracuse hospitals have been

exacerbated by a growing shortage of

nurses. All four hospitals have significant

nursing staff vacancies, which limit their

inpatient and outpatient capacity and

thus their ability to generate revenue.

An ongoing emergency room diversion

program-which directs ambulances to

a hospital with available inpatient beds-

has gained importance as hospitals’ ability

to staff units has eroded. This program

stands as an important remnant of

hospitals’ collaborative approach to

community health problems.

As in the past, there is some

sentiment among local observers that

Syracuse has too many hospitals-and

the Crouse/Community General alliance

has not dramatically changed the Syracuse

hospital environment in this regard.

Local observers disagree about whether

or when a hospital closure might actually

occur, and if it does, which hospital

would close.

Five smaller community hospitals

serve the suburban counties outside of

Syracuse. Neither these community hospitals

nor the four Syracuse hospitals have

sought formal alliances to shore up referral

networks or otherwise expand market

share the way hospitals in other markets

have. The reason may be that the suburban

hospitals are sole community providers

that have considerable bargaining clout

with insurers, and the city hospitals are

satisfied with the referrals and transfers

that they now receive from outside

Syracuse.

Physicians Cast about for Direction and Leverage

any physicians have been left feeling

economically vulnerable in Syracuse’s

highly consolidated insurance market.

With the expectation of growing managed

care and competition, physicians formed

multispecialty independent practice associations

(IPAs) in the late 1990s, which

they hoped would give them more leverage

with health plans and hospitals.

However, over the past two years, one

IPA folded, and the two that remain have

struggled due to low HMO enrollment

and the fact that Excellus has not contracted

with IPAs. As these organizations

faltered, physicians have been left feeling

uneasy in a highly consolidated insurance

market-probably because provider payment

rates have not mirrored recent

insurance premium increases and, in

some cases, have been cut significantly.

Overall, Syracuse remains a market

dominated by solo or small-group physician

practices, and most physicians tend

to be affiliated with one of the four hospitals.

However, some consolidation has

occurred among single specialties. For

example, one group, Hematology-Oncology

Associates of Central New

York, has grown to 12 specialists, while

an orthopedics group, Syracuse Orthopedics

Specialists, is reported to have 17 orthopedists,

representing about 30 to 40

percent of the market. Cardiologists, on

the other hand, have not consolidated

and remain in many small practices

around the Syracuse area, unlike other

markets in which these specialists have

organized into large, powerful practices.

Formal physician-hospital integration

activities in Syracuse appear stagnant

or are faltering. Some hospitals have

reduced their ownership of primary care

practices and have de-emphasized other

arrangements that were expected to lead

to an integrated delivery system model.

Joint contracting with physicians is rare,

and although some hospitals provide

management services to affiliated physicians,

these services are not a major part

of overall market strategies. However, the

recent consolidation of insurers could

renew efforts to develop united negotiating

strategies among hospitals and their

affiliated physicians.

One area of competitive activity among physicians in Syracuse is the development

of ambulatory surgery centers (ASCs). In the wake of the relaxation of state certificate-of-need

rules, a number of physicians have invested in these centers to carve out a new

market niche. Hospitals view the growth of ASCs as a threat, potentially diverting

patients away from their own freestanding centers or outpatient departments. Health

plans, notably Excellus, have voiced concern about the potential for costly overcapacity. any physicians have been left feeling

economically vulnerable in Syracuse’s

highly consolidated insurance market.

With the expectation of growing managed

care and competition, physicians formed

multispecialty independent practice associations

(IPAs) in the late 1990s, which

they hoped would give them more leverage

with health plans and hospitals.

However, over the past two years, one

IPA folded, and the two that remain have

struggled due to low HMO enrollment

and the fact that Excellus has not contracted

with IPAs. As these organizations

faltered, physicians have been left feeling

uneasy in a highly consolidated insurance

market-probably because provider payment

rates have not mirrored recent

insurance premium increases and, in

some cases, have been cut significantly.

Overall, Syracuse remains a market

dominated by solo or small-group physician

practices, and most physicians tend

to be affiliated with one of the four hospitals.

However, some consolidation has

occurred among single specialties. For

example, one group, Hematology-Oncology

Associates of Central New

York, has grown to 12 specialists, while

an orthopedics group, Syracuse Orthopedics

Specialists, is reported to have 17 orthopedists,

representing about 30 to 40

percent of the market. Cardiologists, on

the other hand, have not consolidated

and remain in many small practices

around the Syracuse area, unlike other

markets in which these specialists have

organized into large, powerful practices.

Formal physician-hospital integration

activities in Syracuse appear stagnant

or are faltering. Some hospitals have

reduced their ownership of primary care

practices and have de-emphasized other

arrangements that were expected to lead

to an integrated delivery system model.

Joint contracting with physicians is rare,

and although some hospitals provide

management services to affiliated physicians,

these services are not a major part

of overall market strategies. However, the

recent consolidation of insurers could

renew efforts to develop united negotiating

strategies among hospitals and their

affiliated physicians.

One area of competitive activity among physicians in Syracuse is the development

of ambulatory surgery centers (ASCs). In the wake of the relaxation of state certificate-of-need

rules, a number of physicians have invested in these centers to carve out a new

market niche. Hospitals view the growth of ASCs as a threat, potentially diverting

patients away from their own freestanding centers or outpatient departments. Health

plans, notably Excellus, have voiced concern about the potential for costly overcapacity.

Employers Face Steep Premium Increases

yracuse has enjoyed lower health insurance

premiums than many other markets,

but rates have increased by 15 percent for

two straight years, confronting employers

with rapidly rising costs. Purchaser resistance

to premium increases has been

muted, however, in part because of a

tight labor market, and in part because

Syracuse employers historically have not

taken an active role in shaping the local

health care system. Furthermore, efforts

to contain costs are less effective in an environment

in which hospitals have pushed

for and are now receiving rate increases

after a period of little or no growth.

Syracuse employers have shown little

interest in quality improvement initiatives

or other strategies that could help to shape

the market. Their preference appears to be

for their health plan or third-party administrator

to negotiate with providers and

ensure quality. Their reluctance to get

involved in the health care system is

attributable to a number of factors: a lack

of local leadership, because many large

employers are part of national corporations

with headquarters elsewhere; the dominance

of small, service-sector businesses;

and the influence of unions over the structure

and scope of employee health benefits.

Employers in Syracuse tend to offer indemnity plans or managed care products with

open networks, often PPO or POs products. HMOs’ rates were once comparable to

rates for these looser products, but some Syracuse employers report that recent

increases in HMO premiums have made HMOs more expensive. Employers have not yet

made major changes to benefit or cost-sharing structures in response to these

rate hikes, except in prescription drugs. Formularies were rare in this market

until 1998, but rising drug costs have led some employers to raise their prescription

copayments, move to a three-tier benefit structure or even mandate the use of

generic drugs. Some other employers have increased general cost-sharing amounts

from, for example, $5 per office visit to $10. yracuse has enjoyed lower health insurance

premiums than many other markets,

but rates have increased by 15 percent for

two straight years, confronting employers

with rapidly rising costs. Purchaser resistance

to premium increases has been

muted, however, in part because of a

tight labor market, and in part because

Syracuse employers historically have not

taken an active role in shaping the local

health care system. Furthermore, efforts

to contain costs are less effective in an environment

in which hospitals have pushed

for and are now receiving rate increases

after a period of little or no growth.

Syracuse employers have shown little

interest in quality improvement initiatives

or other strategies that could help to shape

the market. Their preference appears to be

for their health plan or third-party administrator

to negotiate with providers and

ensure quality. Their reluctance to get

involved in the health care system is

attributable to a number of factors: a lack

of local leadership, because many large

employers are part of national corporations

with headquarters elsewhere; the dominance

of small, service-sector businesses;

and the influence of unions over the structure

and scope of employee health benefits.

Employers in Syracuse tend to offer indemnity plans or managed care products with

open networks, often PPO or POs products. HMOs’ rates were once comparable to

rates for these looser products, but some Syracuse employers report that recent

increases in HMO premiums have made HMOs more expensive. Employers have not yet

made major changes to benefit or cost-sharing structures in response to these

rate hikes, except in prescription drugs. Formularies were rare in this market

until 1998, but rising drug costs have led some employers to raise their prescription

copayments, move to a three-tier benefit structure or even mandate the use of

generic drugs. Some other employers have increased general cost-sharing amounts

from, for example, $5 per office visit to $10.

State Shifts Regulatory Focus, Expands Coverage

ew York State has continued its long-standing

support of programs that

expand access to health insurance and

strengthen the local safety net through

expansions of public insurance programs

and direct subsidies for charity care.

Efforts in Syracuse to enroll children and

adults in Medicaid and Child Health Plus,

New York’s State Children’s Health

Insurance Program (SCHIP), by and

large, have been innovative and successful.

The deregulation of hospital rates in 1996,

with subsequent increases in market

competition, has led to a new regulatory

emphasis: oversight of managed care.

Syracuse has mobilized an impressive

program of outreach and decentralized

enrollment for Medicaid managed care

and Child Health Plus, which preceded

the federal SCHIP program by several

years. Ironically, these efforts, which

include all four major hospitals, local

public health and many nontraditional

organizations-such as schools, churches

and community groups-have enrolled

many Medicaid-eligible children in Child

Health Plus. Now federal and state governments

are pushing hard to identify

and move these children out of Child

Health Plus into Medicaid, a situation

that has raised concern that children will

lose coverage and fall between the cracks.

Despite this challenge, implementation

of Child Health Plus and mandatory

Medicaid managed care in Onondaga and

Oswego counties, which started in 1999,

has gone smoothly. Four health plans,

including two commercial insurers

(Excellus and United) and two health plans

that serve only public clients (Total Care

and Fidelis), participate in both programs.

The safety net, comprising the

four Syracuse hospitals and Syracuse

Community Health Center (CHC), is

reasonably stable and expanding modestly

as a result of Child Health Plus and

Medicaid managed care. The funding

pools for charity care and graduate medical

education, which were created in 1996,

and expanded in 1998 as part of the Health

Care Reform Act (HCRA) of 2000, have

mitigated some of the effects that market

changes and dislocation might have had

on care for the uninsured. In addition,

Syracuse CHC has sought innovative program

expansions and revenue streams

more aggressively, and Total Care, its

affiliated health plan, is expanding into

at least two neighboring counties through

contracts with private clinics, a move that

will increase the region’s safety net capacity.

On the other hand, in an effort to

shore up their financial condition, hospitals

have had to cut services in outpatient

clinics used by uninsured patients.

HCRA 2000 established two new

programs designed to extend subsidized

health insurance coverage to additional

populations. Healthy New York began in

January 2001 to subsidize coverage in the

individual and small group markets

through reinsurance pools, which will

cover individuals’ medical costs above a

certain threshold and thus keep individual

and small group premiums lower. Family

Health Plus-slated to start in early 2001

pending federal approval-will expand

Medicaid eligibility to adults ages 19 to 64.

Governor George Pataki’s administration

has brought a strong emphasis on

nonregulatory solutions to health care

issues, starting with deregulation of

hospital rates. This marked shift in state

policy led to a short period of increased

competition and consolidation, but market

forces and the new focus on regulating

managed care have ended that phase.

The state departments of Insurance and

Health share-and, in some cases, compete

over-responsibility for overseeing

the activities of health plans and providers,

most notably the new external review

program and proposed regulations regarding

IPAs and risk-bearing provider organizations.

In addition, New York has invested

considerable resources in producing and

disseminating information about health

plans and providers to consumers and the

general public. Nonetheless, observers are

unclear about the objectives and outcomes

of these information initiatives. ew York State has continued its long-standing

support of programs that

expand access to health insurance and

strengthen the local safety net through

expansions of public insurance programs

and direct subsidies for charity care.

Efforts in Syracuse to enroll children and

adults in Medicaid and Child Health Plus,

New York’s State Children’s Health

Insurance Program (SCHIP), by and

large, have been innovative and successful.

The deregulation of hospital rates in 1996,

with subsequent increases in market

competition, has led to a new regulatory

emphasis: oversight of managed care.

Syracuse has mobilized an impressive

program of outreach and decentralized

enrollment for Medicaid managed care

and Child Health Plus, which preceded

the federal SCHIP program by several

years. Ironically, these efforts, which

include all four major hospitals, local

public health and many nontraditional

organizations-such as schools, churches

and community groups-have enrolled

many Medicaid-eligible children in Child

Health Plus. Now federal and state governments

are pushing hard to identify

and move these children out of Child

Health Plus into Medicaid, a situation

that has raised concern that children will

lose coverage and fall between the cracks.

Despite this challenge, implementation

of Child Health Plus and mandatory

Medicaid managed care in Onondaga and

Oswego counties, which started in 1999,

has gone smoothly. Four health plans,

including two commercial insurers

(Excellus and United) and two health plans

that serve only public clients (Total Care

and Fidelis), participate in both programs.

The safety net, comprising the

four Syracuse hospitals and Syracuse

Community Health Center (CHC), is

reasonably stable and expanding modestly

as a result of Child Health Plus and

Medicaid managed care. The funding

pools for charity care and graduate medical

education, which were created in 1996,

and expanded in 1998 as part of the Health

Care Reform Act (HCRA) of 2000, have

mitigated some of the effects that market

changes and dislocation might have had

on care for the uninsured. In addition,

Syracuse CHC has sought innovative program

expansions and revenue streams

more aggressively, and Total Care, its

affiliated health plan, is expanding into

at least two neighboring counties through

contracts with private clinics, a move that

will increase the region’s safety net capacity.

On the other hand, in an effort to

shore up their financial condition, hospitals

have had to cut services in outpatient

clinics used by uninsured patients.

HCRA 2000 established two new

programs designed to extend subsidized

health insurance coverage to additional

populations. Healthy New York began in

January 2001 to subsidize coverage in the

individual and small group markets

through reinsurance pools, which will

cover individuals’ medical costs above a

certain threshold and thus keep individual

and small group premiums lower. Family

Health Plus-slated to start in early 2001

pending federal approval-will expand

Medicaid eligibility to adults ages 19 to 64.

Governor George Pataki’s administration

has brought a strong emphasis on

nonregulatory solutions to health care

issues, starting with deregulation of

hospital rates. This marked shift in state

policy led to a short period of increased

competition and consolidation, but market

forces and the new focus on regulating

managed care have ended that phase.

The state departments of Insurance and

Health share-and, in some cases, compete

over-responsibility for overseeing

the activities of health plans and providers,

most notably the new external review

program and proposed regulations regarding

IPAs and risk-bearing provider organizations.

In addition, New York has invested

considerable resources in producing and

disseminating information about health

plans and providers to consumers and the

general public. Nonetheless, observers are

unclear about the objectives and outcomes

of these information initiatives.

Issues to Track

nsurer consolidation has replaced hospital

regulation as the main stabilizing force

in Syracuse, a health care market that saw

considerable competitive activity for a

short period in 1997-1998. To cope with

rising premiums-due to both the insurance

underwriting cycle and the lack of

aggressive managed care-purchasers

have been content to adjust their benefit

packages on the margins rather than take

steps to shape the system as a whole.

Likewise, the area’s hospitals have not

undertaken major competitive initiatives

but have focused instead on near-term

efforts to reduce budget shortfalls. After

a brief flirtation with greater integration,

physicians are now concerned about the

power of payers, especially Excellus, to

determine their financial fates. Meanwhile,

New York State has continued its expansion

of public programs that increase

access to the uninsured and strengthen

the local safety net.

As the Syracuse market continues

to unfold, the following issues will be

important to track: nsurer consolidation has replaced hospital

regulation as the main stabilizing force

in Syracuse, a health care market that saw

considerable competitive activity for a

short period in 1997-1998. To cope with

rising premiums-due to both the insurance

underwriting cycle and the lack of

aggressive managed care-purchasers

have been content to adjust their benefit

packages on the margins rather than take

steps to shape the system as a whole.

Likewise, the area’s hospitals have not

undertaken major competitive initiatives

but have focused instead on near-term

efforts to reduce budget shortfalls. After

a brief flirtation with greater integration,

physicians are now concerned about the

power of payers, especially Excellus, to

determine their financial fates. Meanwhile,

New York State has continued its expansion

of public programs that increase

access to the uninsured and strengthen

the local safety net.

As the Syracuse market continues

to unfold, the following issues will be

important to track:

- What effects will the Excellus-Univera

merger have on consumers, provider

networks and relationships and other

health plans?

- Will continuing financial pressures force

any of Syracuse’s four hospitals to close?

- Will providers organize to increase their

market clout, so that they can demand

higher payment rates?

- How will employers cope with rising

health plan premiums for their

employees?

- Will New York’s new insurance expansions

continue the successes of the

Medicaid and Child Health Plus

programs?

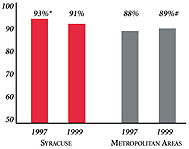

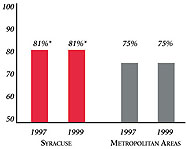

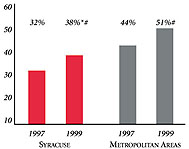

Syracuse’s Experience with the Local Health System, 1997 and 1999

Background and Observations

| Syracuse Demographics |

| Syracuse |

Metropolitan areas above 200,000 population |

Population, July 1, 19991

732,920 |

| Population Change, 1990-19992

|

| -1.3% |

8.6% |

| Median Income3 |

| $24,619 |

$27,843 |

| Persons Living in Poverty3 |

| 14% |

14% |

| Persons Age 65 or Older3 |

| 14% |

11% |

Sources:

1. US Bureau of Census, 1999 Community Population Estimates

2. US Bureau of Census, 1990 & 1999 Community Population Estimates

3. Community Tracking Study Household Survey, 1998-1999 |

| Health Insurance Status |

| Syracuse |

Metropolitan areas above 200,000 population |

| Persons under Age 65 with No Health Insurance1 |

| 9.7% |

15% |

| Children under Age 18 with No Health Insurance1

|

| 3.7% |

11% |

| Employees Working for Private Firms that

Offer Coverage2 |

| 83% |

84% |

| Average Monthly Premium for Self-Only Coverage

under Employer-Sponsored Insurance2 |

| $163 |

$181 |

Sources:

1. Community Tracking Study Household Survey, 1998-1999

2. Robert Wood Johnson Foundation Employer Health Insurance Survey, 1997 |

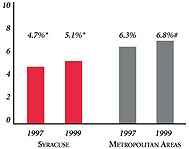

| Health System Characteristics |

| Syracuse |

Metropolitan areas above 200,000 population |

| Staffed Hospital Beds per 1,000 Population1

|

| 2.9 |

2.8 |

| Physicians per 1,000 Population2

|

| 2.4 |

2.3 |

| HMO Penetration, 19973 |

| 19% |

32% |

| HMO Penetration, 19994 |

| 21% |

36% |

Sources:

1. American Hospital Association, 1998

2. Area Resource File, 1998 (includes nonfederal, patient care physicians,

except radiologists, pathologists and anesthesiologists)

3. InterStudy Competitive Edge 8.1

4. InterStudy Competitive Edge 10.1 |

The Community Tracking Study, the major effort of the Center for Studying Health

System Change (HSC), tracks changes in the health system in 60 sites that are

representative of the nation. Every two years, HSC conducts surveys in all 60

communities and site visits in 12 communities. The Community Report series documents

the findings from the third round of site visits. Analyses based on site visit

and survey data from the Community Tracking Study are published by HSC in Issue

Briefs, Data Bulletins and peer-reviewed journals. These publications are

available at www.hschange.org.

Authors of the Syracuse Community Report:

Aaron Katz, University of Washington

Robert E. Hurley, Virginia Commonwealth University

Leslie Jackson, HSC

Timothy K. Lake, Mathematica Policy Research

Ashley Short, HSC

James D. Reschovsky, HSC

Community Reports are published by HSC:

President: Paul B. Ginsburg

Director of Site Visits: Cara S. Lesser

Director of Public Affairs: Ann C. Greiner

Editor: The Stein Group

|