Trends in Offering Employer-Sponsored Coverage

Data Bulletin No. 15

Fall 1998

Stephen H. Long, M. Susan Marquis

Site Variations in Employers Offering Health Insurance

| Site | Offer Now | Offer 2 Years Ago | Change |

| Boston, Mass. | 54% | 48% | 6%* |

| Cleveland, Ohio | 61 | 55 | 6 |

| Phoenix, Ariz. | 48 | 45 | 3 |

| Orange County, Calif. | 47 | 44 | 3 |

| Little Rock, Ark. | 52 | 50 | 2 |

| Greenville, S.C. | 44 | 43 | 1 |

| Newark, N.J. | 47 | 47 | 0 |

| Miami, Fla. | 40 | 40 | 0 |

| Indianapolis, Ind. | 53 | 53 | 0 |

| Seattle, Wash. | 52 | 53 | -1 |

| Lansing, Mich. | 56 | 57 | -1 |

| Syracuse, N.Y. | 50 | 55 | -5* |

| United States | 50 | 50 | 0 |

| * Change is statistically significant at the p<0.05 level. 1997 RWJF Employer Health Insurance Survey | |||

![]() rends in employer-sponsored insurance are important because the bulk of Americans and their families obtain coverage through the workplace. During the late 1980s, the proportion of establishments offering such coverage declined, prompting concern among policy makers. However, subsequent research shows a reversal in this trend in the first half of the 1990s.

rends in employer-sponsored insurance are important because the bulk of Americans and their families obtain coverage through the workplace. During the late 1980s, the proportion of establishments offering such coverage declined, prompting concern among policy makers. However, subsequent research shows a reversal in this trend in the first half of the 1990s.

The most recent results—from the 1997 Robert Wood Johnson Foundation Employer Health Insurance Survey—show that the proportion of employers offering coverage has stabilized recently. Fifty percent of establishments offered coverage at the time of the survey, and the same proportion offered coverage two years earlier.

INSTABILITY OF OFFER DECISION

![]() his stability at the national level masks important variation at the community and individual establishment levels. At the community level, changes in offer rates over the two years ranged from a decrease of 5 percentage points in Syracuse to an increase of 6 percentage points in Boston.

his stability at the national level masks important variation at the community and individual establishment levels. At the community level, changes in offer rates over the two years ranged from a decrease of 5 percentage points in Syracuse to an increase of 6 percentage points in Boston.

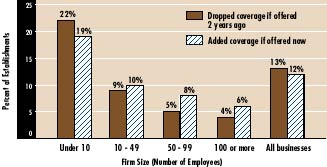

On the individual establishment level, about 13 percent of employers that offered insurance two years ago no longer do so; as a result, their employees no longer have access to coverage through their jobs. On the other hand, about 12 percent of employers who currently offer insurance did not offer it two years ago, so access to coverage for employees in these firms has improved.

Employer Offer of Health Insurance by Size

1997 RWJF Employer Health Insurance Survey

A related finding is that instability in offering insurance is much greater among smaller employers than larger ones. For example, almost one-quarter of the smallest firms that offered insurance two years ago no longer do so, in contrast to only 4 percent of large employers. (See graph) One likely factor behind the greater change in coverage decisions by small employers is exposure to greater variability in prices. In a year in which the average premium increase for small and large firms did not differ much, small firms were more likely to experience both greater increases and greater decreases in the premiums they were charged. For example, 34 percent of small establishments with fewer than 10 employees reported premium changes in excess of 10 percent, in contrast to 19 percent of large firms. (See Data Bulletin No. 14, "Trends in the Cost of Employer-Sponsored Coverage.")

DEPENDENT COVERAGE

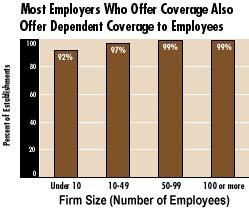

![]() cording to numerous reports, including a recent article in U.S. News & World Report, an increasing number of employers that offer insurance to employees do not provide dependent coverage. However, the 1997 Employer Survey found that offering coverage to dependents is nearly universal: 96 percent of employers that offer coverage also offer employees the opportunity to include their dependents. Virtually all of the largest firms, which account for most workers, offer dependent coverage, and so do even most of the very small firms—those with fewer than 10 employees. Counting workers instead of firms, 98 percent of workers in firms that offer insurance are offered coverage for their dependents as well.

cording to numerous reports, including a recent article in U.S. News & World Report, an increasing number of employers that offer insurance to employees do not provide dependent coverage. However, the 1997 Employer Survey found that offering coverage to dependents is nearly universal: 96 percent of employers that offer coverage also offer employees the opportunity to include their dependents. Virtually all of the largest firms, which account for most workers, offer dependent coverage, and so do even most of the very small firms—those with fewer than 10 employees. Counting workers instead of firms, 98 percent of workers in firms that offer insurance are offered coverage for their dependents as well.

IMPACT ON EMPLOYEES

![]() lthough offer rates by employers have stabilized, whether or not employees enroll in plans depends on factors such as changes in eligibility rules and how much they have to pay for insurance. In fact, recent studies show that employees are increasingly choosing not to enroll in plans.

lthough offer rates by employers have stabilized, whether or not employees enroll in plans depends on factors such as changes in eligibility rules and how much they have to pay for insurance. In fact, recent studies show that employees are increasingly choosing not to enroll in plans.

Moreover, the results presented here show that continued access to coverage is not guaranteed. A sizable number of employers do indeed drop their health plans, leaving workers who participate in these plans without continuity of coverage. In an effort to reduce this churning, states have enacted market reforms, including rating reforms and guaranteed renewal provisions that require plans to offer coverage to current customers. The federal government has also taken action in this regard by requiring guaranteed renewal as part of the Health Insurance Portability and Accountability Act of 1996.

Offer of Dependent Coverage by Firm Size

1997 RWJF Employer Health Insurance Survey

This Data Bulletin presents results from the 1997 Robert Wood Johnson Foundation Employer Health Insurance Survey, a nationally representative telephone survey of private and public employers. It is based on responses of 21,543 private establishments. The survey is a component of Health System Change’s (HSC’s) Community Tracking Study. It was conducted by Research Triangle Institute (RTI) and designed by RAND and RTI, with collaboration from HSC.