Tracking Health Care Costs: Trends Turn Downward in 2003

Data Bulletin No. 27

June 2004

Bradley C. Strunk, Paul B. Ginsburg

![]() ealth care spending per privately insured American increased

7.4 percent in 2003—the first major slowdown in spending

growth in nearly a decade. Nonetheless, health spending grew

nearly twice as fast as the overall economy in 2003 (see Table 1).

ealth care spending per privately insured American increased

7.4 percent in 2003—the first major slowdown in spending

growth in nearly a decade. Nonetheless, health spending grew

nearly twice as fast as the overall economy in 2003 (see Table 1).

While still extremely high, the rate of health spending growth slowed for the second year in a row in 2003, down from 9.5 percent in 2002 and 10 percent in 2001. Trends in all four spending categories—inpatient and outpatient hospital care, prescription drugs, and physician services—continued to slow in 2003. Moreover, the decline in spending growth appeared to slow growth in employersponsored health insurance premiums to an average 12 percent in 2004, marking the first downtick in premium growth since 1996.

| TABLE 1: Annual Change Per Capita in Health Care Spending and Gross Domestic Product, 1994-2003 | ||||||

|

|

Spending on Type of Health Care Service

|

|

||||

|

Year

|

All Services

|

Hospital Inpatient

|

Hospital Outpatient

|

Physician

|

Prescription Drugs

|

Gross Domestic

Product (GDP) |

| 1994 |

2.1%

|

-2.0%

|

8.7%

|

1.7%

|

5.2%

|

4.9%

|

| 1995 |

2.2

|

-3.5

|

7.9

|

1.9

|

10.6

|

3.4

|

| 1996 |

2.0

|

-4.4

|

7.7

|

1.6

|

11.0

|

4.4

|

| 1997 |

3.3

|

-5.3

|

9.5

|

3.4

|

11.5

|

5.0

|

| 1998 |

5.3

|

-0.2

|

7.5

|

4.7

|

14.1

|

4.1

|

| 1999 |

7.1

|

1.6

|

10.2

|

5.0

|

18.4

|

4.8

|

| 2000 |

7.8

|

4.1

|

9.8

|

6.3

|

14.5

|

4.8

|

| 2001 |

10.0

|

8.7

|

14.6

|

6.7

|

13.8

|

1.8

|

| 2002 |

9.5

|

8.4

|

12.9

|

6.5

|

13.2

|

2.7

|

| 2003 |

7.4

|

6.5

|

11.0

|

5.1

|

9.1

|

3.8

|

| Notes: GDP is in nominal dollars. Estimates may differ from past reports due to data revisions by Milliman USA and the Bureau of Economic Analysis. Sources: Health care spending data are the Milliman USA Health Cost Index ($0 deductible); GDP is from the U.S. Department of Commerce, Bureau of Economic Analysis |

||||||

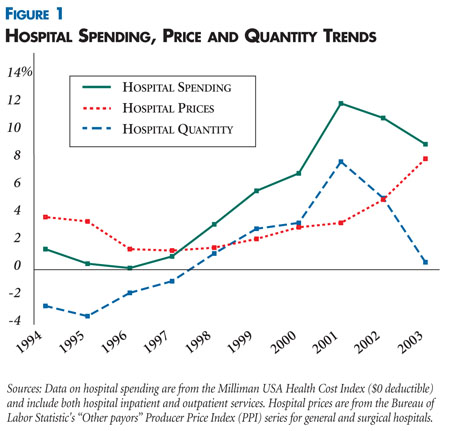

Hospital spending. Spending on inpatient services increased 6.5 percent in 2003, down from 8.4 percent in 2002. Spending on outpatient care 1 increased 11 percent—making it the fastest growing category of health spending—down from 12.9 percent in 2002. Taken together, spending growth on inpatient and outpatient care accounted for 53 percent of the total increase in health spending in 2003.

While the hospital utilization trend slowed sharply in 2003, hospital price increases accelerated for the sixth year in a row. Hospital prices—for inpatient and outpatient care combined—increased 8 percent in 2003, the largest one-year rise since measurement of negotiated hospital prices began a decade ago (see Figure 1). Price increases accounted for most of the overall increase in hospital spending in 2003.

Prescription drugs. For the fourth year in a row, prescription drug spending per privately insured person increased at a slower pace, growing 9.1 percent in 2004—substantially lower than the 2002 increase of 13.2 percent and less than half the 1999 peak increase of 18.4 percent. Slowing of trends for both drug prices and utilization played a role in this turnaround. Several factors explain why drug price and utilization trends slowed, including increased patient cost sharing, fewer new drug introductions and greater use of generic drugs. Prescription drug spending accounted for 20 percent of the overall total spending increase in 2003 compared with 34 percent in 1999.

Physician care. Spending on physician care increased 5.1 percent in 2003 compared with 6.5 percent in 2002. This slowdown reflects a sharp decline in the rate of growth of physician use, while growth in prices for physician services increased slightly.

Outlook

After a long period of steady acceleration, the cost trend finally turned down in 2003, and the slowdown already has sparked a decline in the premium trend. Nevertheless, premium growth continues to be much higher than growth in workers’ compensation, making health insurance increasingly difficult to afford. Most efforts to slow trends have involved increased patient cost sharing, but completion of the transition to looser forms of managed care probably played a larger role in slowing cost trends.

As patient cost sharing increases, benefit structures may change to encourage patients to use efficient providers or choose more effective therapies. Nevertheless, many factors make it unlikely that increased patient cost sharing alone will significantly slow cost trends over time. Research is clear that the key long-term driver of cost trends is technological advancement in medical care. A financing system that aids the rapid diffusion of expensive new technologies by paying most of their cost—even in the absence of careful consideration of clinical effectiveness—has probably been a factor in the overall cost impact of new technologies.

Costs—and therefore premiums—will likely continue to outstrip growth in the overall U.S. economy by a significant margin for the foreseeable future. Although some argue that ever-higher spending for medical care is a good thing, the continuing rapid growth in health spending will make insurance unaffordable to more and more people. Ultimately, policy makers are likely to confront a stark trade-off between health care costs and access, perhaps leading to a willingness to discuss taboo subjects, such as rationing of health care.

Sources

This Data Bulletin is based on data from the Milliman USA Health Cost Index ($0 deductible), which is designed to reflect claims trends faced by private insurers; the U.S. Bureau of Labor Statistics’ (BLS) Producer Price Index for general medical and surgical hospitals and for physicians’ offices to track hospital and physician prices; the BLS’s Consumer Price Index for prescription drugs and medical supplies to track prescription drug prices; and the Towers Perrin 2004 Health Care Cost Survey and the Ninth Annual National Business Group on Health/Watson Wyatt Employer Survey Report 2004 for premium trends. It is adapted from "Tracking Health Care Costs: Trends Turn Downward in 2003" by Bradley C. Strunk and Paul B. Ginsburg, Health Affairs, Web-exclusive publication, June 9, 2004, www.healthaffairs.org.

Data Bulletins are published by the Center for Studying Health System Change

(HSC)

President: Paul B. Ginsburg

Vice President: Len M. Nichols