Rising Health Costs, Medical Debt and Chronic Conditions

Issue Brief No. 88

September 2004

Ha T. Tu

About 57 million working-age Americans—18-64 years old—live with chronic conditions, such as diabetes, asthma or depression. In 2003, more than one in five, or 12.3 million people with chronic conditions, lived in families with problems paying medical bills, according to a new study by the Center for Studying Health System Change (HSC). Rising health costs have hit low-income, privately insured people with chronic conditions particularly hard. Between 2001 and 2003, the proportion of low-income, chronically ill people with private insurance who spent more than 5 percent of their income on out-of-pocket health care costs grew from 28 percent to 42 percent. For the 6.6 million uninsured, chronically ill Americans, the financial consequences are especially grave—nearly half reported medical bill problems, making them much more likely to forgo or delay needed medical care. Among the 3 million uninsured, chronically ill people with medical bill problems, four in 10 went without needed care, two in three put off care and seven in 10 did not fill a prescription in the past year because of cost concerns.

- The Financial Burden of Chronic Conditions

- People with Chronic Conditions Face Higher Out-of-Pocket Costs

- Low Incomes, Lack of Insurance Key to Medical Bill Problems

- Large Medical Bills Linked to Family Finance, Access Problems

- Implications

- Notes

- Data Source

- Supplementary Tables

The Financial Burden of Chronic Conditions

![]() he high and rising cost of health care

causes financial problems for many

Americans,1 but people living with chronic

conditions—such as diabetes, asthma or

depression—are especially vulnerable to

problems paying medical bills. Because

many chronic conditions require ongoing

medical care, people living with chronic

conditions often face higher out-of-pocket

spending on medical care.2 Estimating

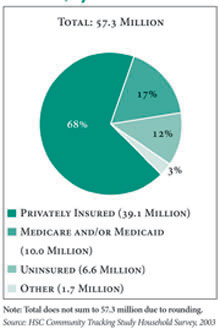

conservatively, 57.3 million working-age

Americans—33 percent of the working-age

population—have at least one chronic condition,

according to HSC’s 2003 Community

Tracking Study (CTS) Household Survey

(see Data Source).

he high and rising cost of health care

causes financial problems for many

Americans,1 but people living with chronic

conditions—such as diabetes, asthma or

depression—are especially vulnerable to

problems paying medical bills. Because

many chronic conditions require ongoing

medical care, people living with chronic

conditions often face higher out-of-pocket

spending on medical care.2 Estimating

conservatively, 57.3 million working-age

Americans—33 percent of the working-age

population—have at least one chronic condition,

according to HSC’s 2003 Community

Tracking Study (CTS) Household Survey

(see Data Source).

Among working-age people with chronic conditions, more than one in five, or 12.3 million people, lived in families reporting problems paying medical bills in the past year. Such problems are especially acute for the 6.6 million uninsured people living with chronic conditions (see Figure 1), with almost half of them reporting medical bill problems. Among these 3 million uninsured, chronically ill people whose families had medical bill problems, 42 percent went without needed care, 65 percent delayed care and 71 percent failed to get needed prescription drugs—all because of cost concerns.

While uninsured working-age people with chronic conditions are more likely to have problems paying for and accessing care, many insured people also face problems. Indeed, a majority of the chronically ill working-age adults who report high health care costs and access problems are covered by private insurance. Even for insured people, low incomes—defined as family income below 200 percent of the federal poverty level, or $36,800 for a family of four in 2003—increase the likelihood of medical bill problems. Between 2001 and 2003, the proportion of low-income, chronically ill people with private insurance who spent more than 5 percent of their income on out-of-pocket health care costs grew from 28 percent to 42 percent, a 50 percent increase to 2.2 million people.

Back to Top

Figure 1 |

|

People with Chronic Conditions Face Higher Out-of-Pocket Costs

![]() eople with chronic conditions are more

likely to spend a greater share of their

income on out-of-pocket medical costs (see

Table 1). Across the entire working-age

population in 2003, 12 percent reported

family out-of-pocket health costs exceeding

5 percent of family income.3 Among only

working-age adults with chronic conditions,

the proportion with out-of-pocket

costs greater than 5 percent of income was

19 percent.

eople with chronic conditions are more

likely to spend a greater share of their

income on out-of-pocket medical costs (see

Table 1). Across the entire working-age

population in 2003, 12 percent reported

family out-of-pocket health costs exceeding

5 percent of family income.3 Among only

working-age adults with chronic conditions,

the proportion with out-of-pocket

costs greater than 5 percent of income was

19 percent.

In 2003, 38 percent of low-income, chronically ill people had out-of-pocket health costs greater than 5 percent of family income, compared with 8 percent of chronically ill people with family incomes higher than 400 percent of poverty.

Insurance coverage also makes a big difference to the out-of-pocket cost burden: 35 percent of all uninsured, chronically ill people reported health costs exceeding 5 percent of income, compared with 13 percent of privately insured, chronically ill people. However, that 13 percent translates into 5.1 million privately insured people with chronic conditions whose health costs exceeded 5 percent of income—more than twice the 2.2 million uninsured people whose health spending exceeded 5 percent of income. Out-of-pocket costs exclude health insurance premiums paid by insured people, so 5 percent of income is a conservative estimate of what insured people spend on health care overall.

Between 2001 and 2003, the proportion of people with high out-of-pocket costs relative to income increased overall. The increase occurred almost completely within the privately insured group, and the increase was most pronounced for low-income people. The proportion of lowincome, privately insured, chronically ill people with out-of-pocket costs exceeding 5 percent of family income increased from 28 percent in 2001 to 42 percent in 2003—an increase of 50 percent. This change likely reflects the impact of increased patient cost sharing for insured people, as well as the fact that health care costs increased at a much faster pace than incomes. By 2003, low-income, chronically ill people covered by private insurance had become as likely by private insurance had become as likely as their low-income, uninsured counterparts to spend at least 5 percent of income on health care.

Back to Top

Table 1

Out-of-Pocket Medical Costs Exceeding 5% of Family Income

|

Out-of-Pocket Medical Costs Greater Than 5% or Income

|

||||||

|

All

|

Privately Insured

|

Uninsured

|

||||

|

2001

|

2003

|

2001

|

2003

|

2001

|

2003

|

|

| All Working-Age Adults |

10%

|

12%*

|

7%

|

9%*

|

18%#

|

21%#

|

| Health Adults |

5

|

7*

|

4

|

6*

|

10#

|

14#

|

| Working-Age Adults with Chronic Conditions |

15

|

19*

|

10

|

13*

|

34#

|

35#

|

| Less than 200% Poverty |

31

|

38*

|

28

|

42*

|

42#

|

40

|

| 200-399% Poverty |

12

|

15*

|

10

|

13*

|

20#

|

25#

|

| 400% Poverty or More |

6

|

8*

|

5

|

6

|

27#

|

35#

|

| Note: Out-of-pocket costs reported here do not include health insurance premiums paid by insured people, and thus do not

capture the full extent of health-care-related expenses paid by this group. * Change from 2001 to 2003 statistically significant at p <.05. # Difference between privately insured and uninsured statistically significant at p <.05. Source: HSC Community Tracking Study Household Survey, 2001 and 2003 |

||||||

Low Incomes, Lack of Insurance Key to Medical Bill Problems

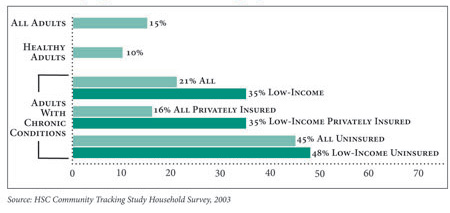

![]() orking-age adults with chronic conditions

were more than twice as likely as

healthy working-age adults to live in families

that had problems paying medical bills

in the past year—21 percent vs. 10 percent

(see Figure 2). In comparison, 35 percent of

low-income people with chronic conditions

lived in families with medical bill problems.

orking-age adults with chronic conditions

were more than twice as likely as

healthy working-age adults to live in families

that had problems paying medical bills

in the past year—21 percent vs. 10 percent

(see Figure 2). In comparison, 35 percent of

low-income people with chronic conditions

lived in families with medical bill problems.

Uninsured people with chronic conditions are especially vulnerable to medical bill problems: almost half (45%, or 3 million people) are in families with such problems. However, even people covered by private insurance are not immune to these financial concerns: one in six privately insured people with chronic conditions (16%, or 6.4 million people) live in families with medical bill problems. Among those who are privately insured but low income, 35 percent—almost 2 million people—have family medical bill problems. While this rate is lower than the 48 percent for uninsured, low-income adults with chronic conditions, it underscores the limitations of health insurance alone in protecting people from the high costs of treating chronic conditions.

Back to Top

Figure 2 |

|

Large Medical Bills Linked to Family Finances, Access Problems

![]() mong working-age adults with chronic

conditions whose families had problems

paying medical bills in the past year,

negative effects on other aspects of family

finances are common: 68 percent of

their families had problems paying for

other necessities, such as food and shelter;

64 percent were contacted by a collection

agency; 55 percent put off major purchases;

and 50 percent had to borrow money. More

than nine in 10 families with medical bill

problems faced at least one of these negative

effects on family finances, and almost a

quarter experienced all four.

mong working-age adults with chronic

conditions whose families had problems

paying medical bills in the past year,

negative effects on other aspects of family

finances are common: 68 percent of

their families had problems paying for

other necessities, such as food and shelter;

64 percent were contacted by a collection

agency; 55 percent put off major purchases;

and 50 percent had to borrow money. More

than nine in 10 families with medical bill

problems faced at least one of these negative

effects on family finances, and almost a

quarter experienced all four.

Medical bill problems also have serious consequences for access to medical care. People with chronic conditions whose families have medical bill problems are four to five times as likely to forgo or delay care because of cost concerns as those whose families reported no medical bill problems (see Table 2). Among chronically ill people whose families had trouble paying medical bills, 19 percent (2.4 million people) went without needed care, 38 percent (4.7 million people) delayed care, and 53 percent (6.6 million people) failed to get needed prescription drugs because of cost concerns.

As high as these rates of access problems are overall, problems are especially acute for the uninsured. Among uninsured people with chronic conditions and family problems with medical bills, 42 percent went without care, 65 percent delayed care and 71 percent did not fill a prescription because of cost concerns.

Rates of access problems for the privately insured with medical bill problems, while lower than for the uninsured, are still considerable: 10 percent went without care, 30 percent delayed care and 43 percent did not fill a prescription because of cost concerns. These results suggest that once families have trouble paying medical bills, concerns about accumulating more bills and further straining family finances may cause many people with chronic conditions to curtail their use of needed medical services.

Back to Top

Table 2

Access Problems for People with Chronic Conditions, by Insurance Status and

Family Medical Bill Problems

|

All

|

Privately Insured

|

Uninsured

|

|

| Unmet Need Due to Cost | |||

| All Adults 18-64 with Chronic Conditions |

7%

|

4%

|

24%

|

| In Families Without Problems Paying Medical Bills |

4

|

3

|

9

|

| In Families with Problems Paying Medical Bills |

19

|

10

|

42

|

| Delayed Care Due to Cost | |||

| All Adults 18-64 with Chronic Conditions |

16

|

12

|

46

|

| In Families without Problems Paying Medical Bills |

10

|

8

|

32

|

| In Families with Problems Paying Medical Bills |

38

|

30

|

65

|

| Unmet Need for Drugs Due to Cost | |||

| All Adults 18-64 with Chronic Conditions |

22

|

15

|

49

|

| In Families without Problems Paying Medical Bills |

13

|

9

|

32

|

| In Families with Problems Paying Medical Bills |

53

|

43

|

71

|

| Note: Differences between privately insured and uninsured

and those with and without medical bill problems are statistically significant

in all cases at p <.05. Source: HSC Community Tracking Study Household Survey, 2003 |

|||

Implications

![]() he finding that people with chronic

conditions bear higher out-of-pocket cost

burdens than other adults is hardly surprising.

However, the extent of the cost

burden and the degree to which it impedes

timely access to medical care are cause for

concern. Failure to receive preventive and

ongoing care for chronic conditions can

result in serious health consequences for

patients.

he finding that people with chronic

conditions bear higher out-of-pocket cost

burdens than other adults is hardly surprising.

However, the extent of the cost

burden and the degree to which it impedes

timely access to medical care are cause for

concern. Failure to receive preventive and

ongoing care for chronic conditions can

result in serious health consequences for

patients.

The uninsured chronically ill—who are mostly low income—bear the heaviest out-of-pocket cost burden and frequently put off or go without needed care. Clearly, affordable insurance coverage would give this vulnerable group a measure of financial protection and help to narrow very large access gaps.

Uninsured people who have chronic conditions and need medical care must shoulder high and rising costs on their own or rely on a network of charity care. Increased funding for community health centers in recent years has helped to improve primary care access for lowincome and uninsured people, but access varies widely across communities.4 And even in communities with strong safety nets, access to specialty services and prescription drugs—both essential to many people with chronic conditions—continue to present major problems.

The financial burden borne by Americans living with chronic conditions may well increase in the future. Along with the growth in the number of uninsured people over time and the fact that health care costs are rising more rapidly than incomes, many employers continue to increase patient cost sharing through higher deductibles, copayments and coinsurance, where patients pay a percentage of the bill instead of a fixeddollar copayment.

Recent studies have found that doubling a drug copayment from $10 to $20 triggered substantial cutbacks in the use of important prescription drugs, such those used to treat diabetes and high cholesterol.5 Conversely, an employer experiment that reduced employee copayments for diabetes and asthma drugs resulted in fewer emergency room visits and hospital stays for those conditions. Such results may encourage employers and insurers to explore what one insurer calls “evidence-based co-pays,” where copayments would be reduced or waived for clinically valuable and costeffective treatments.6

Another cost-sharing refinement—one that would give financial relief to low-income workers—is varying cost-sharing levels according to income. Some employers already tie premium contribution levels to income; the approach could be extended to patient cost sharing by varying either deductibles or out-of-pocket maximums.7

Many chronically ill people faced with high out-of-pocket costs may find little appeal in insurance options that emphasize broad provider choice for patients but demand greater financial risk, such as high deductibles. Indeed, for many in this population, options that restrict choice of providers in exchange for lower out-of-pocket expenses may prove a better fit. CTS data show a majority of Americans with chronic conditions being willing to give up provider choice in order to save on out-of-pocket costs, and the lower a person’s income, the stronger the willingness to make this tradeoff (see Supplementary Table 2). Traditional closed-network health plans, which fell out of favor in recent years, may merit a second look for the relatively low out-of-pocket costs they offer. Tiered-provider networks, which have yet to be widely adopted, may provide another cost-saving option for patients willing to limit their choice of doctors and hospitals.

Back to Top

Notes

| 1. | May, Jessica H. and Peter J. Cunningham, Tough Trade-offs: Medical Bills, Family Finances and Access to Care, Issue Brief No. 85, Center for Studying Health System Change, Washington, D.C. (June 2004). |

| 2. | Hwang, Wenke, et al., “Out-of-Pocket Medical Spending for Care of Chronic Conditions,” Health Affairs, Vol. 20, No. 6 (November/December 2001). |

| 3. | The benchmark of 5 percent was used for out-of-pocket-spending-to-income because at this level of health care spending, about 50 percent of people reported family medical bill problems. An alternative analysis of out-of-pocket costs relative to income was conducted using 10 percent as the benchmark. The patterns shown in that analysis are consistent with the 5 percent results. See Supplementary Table 1 to see percentages of people with out-ofpocket costs greater than 10 percent of income. |

| 4. | Felland, Laurie E., Suzanne Felt- Lisk and Megan McHugh, Health Care Access for Low-Income People: Significant Safety Net Gaps Remain, Issue Brief No. 84, Center for Studying Health System Change, Washington, D.C. (June 2004). |

| 5. | Goldman, Dana P., et al., “Pharmacy Benefits and the Use of Drugs by the Chronically Ill,” Journal of the American Medical Association, Vol. 291, No. 19 (May 12, 2004); Ellis, Jeffrey J., et al., “Suboptimal Statin Adherence and Discontinuation in Primary and Secondary Prevention Populations,” Journal of General Internal Medicine, Vol. 19 (June 2004). |

| 6. | Hensley, Scott, “Follow the Money: From ‘One Size Fits All’ to Tailored Co-Payments,” The Wall Street Journal, June 16, 2004. |

| 7. | Trude, Sally, Patient Cost Sharing: How Much Is Too Much?, Issue Brief No. 72, Issue Brief No. 72, Center for Studying Health System Change, Washington, D.C. (December 2003). |

Back to Top

Data Source

The findings reported in this Issue Brief are based on an analysis of the 2003 CTS Household Survey, a nationally representative survey involving information on about 24,500 families and 46,600 people. The survey asked adult respondents, including 31,935 working-age adults, whether they had been diagnosed with one of more than 10 chronic conditions and whether they had seen a doctor in the past two years for the condition.The list of chronic for the condition.The list of chronic conditions includes asthma, arthritis, diabetes, chronic obstructive pulmonary disease, heart disease, hypertension, cancer,benign prostate enlargement, abnormal uterine bleeding and depression. Because the CTS list of conditions is not exhaustive, the estimate of the prevalence of chronic conditions is likely conservative. In comparison, 41 percent of working-age adults reported at least one chronic condition in the 1996 Medical Expenditure Panel Survey.

Back to Top

Supplementary Tables

Supplementary Table 1: Out-of-Pocket

Medical Costs Exceeding 10% of Family Income

Supplementary Table 2: Willingness

to Trade Provider Choice for Lower Costs

ISSUE BRIEFS are published by the

Center for Studying Health System Change.

600 Maryland Avenue, SW, Suite 550

Washington, DC 20024-2512

Tel: (202) 484-5261

Fax: (202) 484-9258

www.hschange.org

Vice President: Len M. Nichols